Latest Version

Version

25.3.1

25.3.1

Update

April 10, 2025

April 10, 2025

Developer

Banco Santander (Brasil) S.A.

Banco Santander (Brasil) S.A.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

br.com.santander.way

br.com.santander.way

Report

Report a Problem

Report a Problem

More About Santander Way: App de cartões

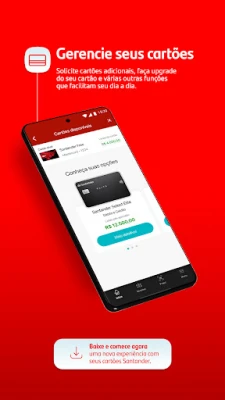

Com o Way, você acompanha em tempo real todos os detalhes dos seus cartões Santander e faz a gestão completa do seu consumo. Way: mais autonomia e segurança no seu dia a dia.

Ultimate Guide to Managing Your Credit Cards Effectively

Managing your credit cards efficiently is essential for maintaining financial health and maximizing benefits. This comprehensive guide will walk you through the various features and functionalities available for effective credit card management, ensuring you make the most of your financial tools.Unlock and Activate Your Cards

To start managing your credit cards, the first step is to unlock and activate both your primary and additional cards. This process is crucial for ensuring that you can access all the features and benefits associated with your cards.Monitor Your Balance and Transactions

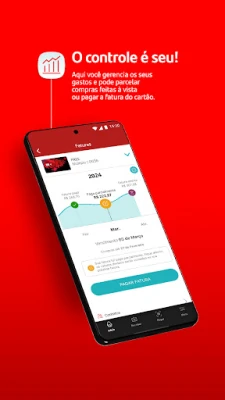

Stay informed about your financial status by regularly checking your balance and transaction history. You can view your Esfera balance and keep track of your spending in real-time. This feature allows you to manage your finances effectively and avoid overspending.Manage Your Credit Limits

Understanding and managing your credit limits is vital. You can easily consult and adjust the limits for both your primary and additional cards. This flexibility helps you maintain control over your spending and ensures you stay within your budget.Enable International Usage

Planning to travel? Make sure to enable your cards for international use by continent. This feature ensures that you can use your credit cards without any hassle while abroad, providing peace of mind during your travels.Track Recent Purchases

Keep an eye on your spending habits by viewing your most recent purchases in real-time. This feature allows you to categorize your expenses, whether they were made using credit or debit, and whether they were online transactions or in-store purchases.Check Card Status Easily

For a quick overview of your card's status, simply navigate to the Summary screen. This feature provides a snapshot of your card's current standing, making it easy to stay informed.Request Additional Cards

If you need extra cards for family members or trusted individuals, you can easily request an additional card. This feature allows you to extend your credit benefits to others while maintaining control over the account.Redeem Rewards with Ease

If you have a Rewards Card, you can consult and redeem your rewards effortlessly. This exclusive feature allows you to take full advantage of the benefits your card offers.Top Up Your Mobile Phone

Convenience is key, and with the ability to recharge your mobile phone directly from your credit card management interface, you can ensure you never run out of balance.Manage Your Billing Statements Anytime

Stay on top of your finances by managing your billing statements at your convenience. Here’s how:- Visualize Your Statements: View your recent statements in graphical format for easy understanding.

- Receive Notifications: Get alerts about your statement closure, due dates, and any potential delays.

- Email Your Statements: Register to receive your statements via email for easy access.

- Installment Options: If needed, you can choose to split your bill into manageable installments.

- Request Duplicate Statements: Easily request a second copy of your statement via email or PDF.

- Set Up Automatic Payments: For account holders, you can register for automatic debit payments.

- Copy Payment Codes: Quickly copy the barcode for hassle-free bill payments.

- Optimal Purchase Timing: Consult to find the best days for making purchases.

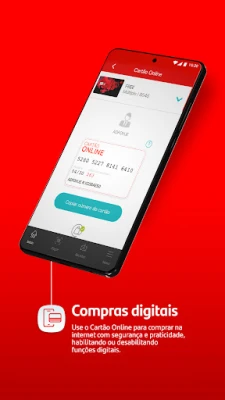

Secure Transactions and Purchases

Safety is paramount when it comes to financial transactions. Here are some essential tips for secure purchases:- Generate Online Cards: Create virtual cards for online shopping to enhance security.

- Temporarily Block Cards: If you suspect any fraudulent activity, you can temporarily block your cards for added security.

- Report Lost or Stolen Cards: In case of loss or theft, block your card immediately and request a replacement.

- Access Security Codes: Always check your card’s security code and password for safe transactions.

- Dispute Unauthorized Transactions: If you notice any unrecognized transactions, you can contest them promptly.

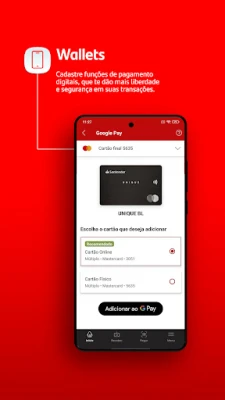

Streamlined Payment Options

Make payments easier with the following features:- Pay Your Credit Card Bill: For account holders, paying your credit card bill is straightforward and convenient.

- Pay Other Bills: Non-account holders can also pay bills using their Santander credit card.

Not a Customer Yet?

If you haven’t joined us yet, you can easily apply for a credit card through our Way platform. Enjoy the benefits of credit management and financial flexibility today!Conclusion

Effective credit card management is essential for financial well-being. By utilizing the features outlined in this guide, you can take control of your finances, make informed decisions, and enjoy the benefits that come with responsible credit card use. Start managing your credit cards today and unlock a world of financial possibilities!Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

Nova BrowserJef Studios

Throne WishlistThrone.com

XENO; Plan, AutoSave & InvestXENO Investment

CHANCE THE GAMETake Your Chance !

Dot PaintingChill Calm Cute

Dark Web Browser : OrNETStronger Apps

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD