Latest Version

6.0.0

March 31, 2025

National Westminster Bank PLC

Finance

Android

0

Free

com.rbs.clearspend

Report a Problem

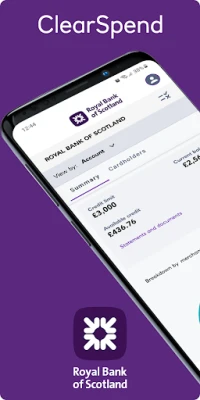

More About Royal Bank ClearSpend

Unlocking Financial Control: The Ultimate Guide to Royal Bank ClearSpend

In today's fast-paced business environment, managing finances efficiently is crucial. Royal Bank ClearSpend offers a comprehensive solution for businesses looking to streamline their financial operations. This article delves into the key features of ClearSpend, ensuring you have all the information you need to take full advantage of this innovative tool.

Real-Time Balance Information

Stay on top of your finances with real-time balance information. ClearSpend provides instant access to your account balance, allowing you to make informed decisions on the go. No more waiting for end-of-day reports; you can monitor your financial status anytime, anywhere.

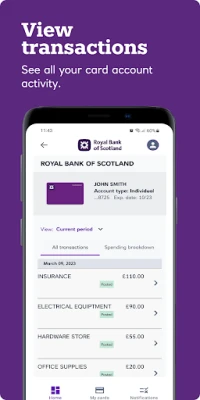

Transaction Insights: View Transactions, Pending and Declines

Understanding your spending habits is essential for effective financial management. With ClearSpend, you can easily view transactions, including pending and declined purchases. This feature helps you track expenses and identify any discrepancies in real-time, ensuring transparency and accountability.

Access Regular Statements

ClearSpend simplifies financial oversight by allowing users to view regular statements. These statements provide a comprehensive overview of your spending patterns, making it easier to analyze and adjust your budget as needed. With this feature, you can maintain a clear picture of your financial health.

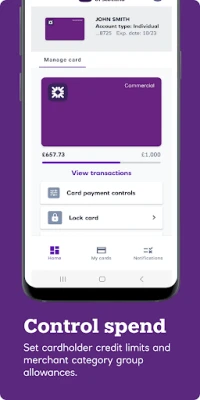

Set Cardholder Credit Limits

Control spending by setting cardholder credit limits. This feature empowers administrators to define spending thresholds for each cardholder, ensuring that expenses remain within budget. By implementing these limits, businesses can prevent overspending and promote responsible financial practices.

Merchant Category Blockings for Enhanced Security

Enhance your financial security by utilizing merchant category blockings. This feature allows administrators to restrict cardholder transactions to specific merchant categories, reducing the risk of unauthorized purchases. Tailoring spending categories ensures that funds are allocated appropriately and securely.

Lock and Unlock Employee Cards

In the event of a lost or stolen card, ClearSpend offers the ability to lock and unlock an employee’s card instantly. This feature provides peace of mind, allowing businesses to protect their assets quickly and efficiently. Reacting promptly to potential security threats is essential in today’s digital landscape.

Receive Transaction Notifications

Stay informed with transaction notifications. ClearSpend sends real-time alerts for every transaction made, keeping you updated on spending activities. This feature not only enhances security but also helps in monitoring expenses closely, allowing for timely adjustments to financial strategies.

Approve Online Purchases Instantly

Streamline your purchasing process with the ability to approve online purchases directly through the app. This feature allows administrators to review and authorize transactions in real-time, ensuring that all expenditures align with company policies and budgets.

Create Departments to Segregate Spending

Organize your financial management by creating departments within ClearSpend. This feature enables businesses to segregate spending by department, providing clearer insights into where funds are allocated. By categorizing expenses, companies can better analyze their financial performance and make informed decisions.

Dedicated App for Administrators and Cardholders

The ClearSpend app is designed for both administrators and cardholders, providing a user-friendly interface for managing finances. With features tailored to each user role, the app ensures that everyone has the tools they need to maintain financial control effectively.

Easy Registration Process

Getting started with Royal Bank ClearSpend is a breeze. The registration process takes just a few minutes. Simply download the app, click on ‘Need to register,’ and follow the on-screen instructions. Remember, the Business or Commercial Card account must be registered and activated before cardholder users can sign up.

Eligibility and Availability

Royal Bank ClearSpend is available to eligible Royal Bank Business and Commercial Card account customers. To use the app, you need a compatible Android device and a UK or international mobile number from specific countries. Please note that users must be over 18 years old, and other terms and conditions apply.

Conclusion: Empower Your Business with Royal Bank ClearSpend

Royal Bank ClearSpend is a powerful tool for businesses seeking to enhance their financial management. With features like real-time balance information, transaction insights, and customizable spending controls, ClearSpend empowers users to take charge of their finances. By leveraging this innovative app, businesses can achieve greater financial clarity and control, paving the way for informed decision-making and sustainable growth.

Rate the App

User Reviews

Popular Apps

Editor's Choice