Latest Version

1.12

April 14, 2025

Republic Bank & Trust Company

Finance

Android

0

Free

com.republicbank.cardcontrol

Report a Problem

More About Republic Bank Card Controls

Maximize Your Financial Control with Republic Bank's Innovative Card Management Features

In today's fast-paced digital world, managing your finances effectively is more crucial than ever. Republic Bank, serving customers in Kentucky, Indiana, Florida, Ohio, and Tennessee, offers cutting-edge card management features that empower cardholders to take control of their payment cards directly from their mobile devices. This article explores how these features enhance security and convenience, allowing you to manage your spending with ease.

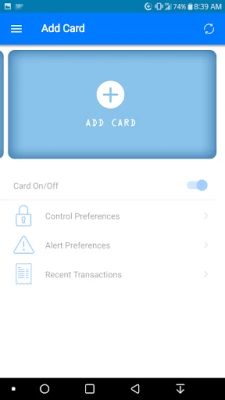

Empower Your Spending with Mobile Control

With Republic Bank's mobile app, cardholders can easily manage their payment cards at their fingertips. This innovative technology allows you to control how, where, and when your cards are used, ensuring that you have the ultimate authority over your finances. Whether you’re at home or on the go, you can make real-time adjustments to your card settings.

Instant Card Activation and Deactivation

One of the standout features of Republic Bank's card management system is the ability to turn your card on or off with just a touch of a button. If you misplace your card or suspect unauthorized use, you can instantly deactivate it through the mobile app. This feature not only provides peace of mind but also enhances your financial security by preventing potential fraud.

Location-Based Controls for Enhanced Security

Location-based controls are another powerful tool offered by Republic Bank. This feature allows you to set restrictions on where your card can be used, adding an extra layer of security. For instance, if you frequently travel, you can adjust your settings to allow transactions only in specific geographic areas. This proactive approach helps safeguard your finances against unauthorized transactions while you’re away from home.

Block International Transactions with Ease

For those who prefer to keep their finances secure while traveling abroad, Republic Bank provides the option to block international transactions. This feature is particularly useful for cardholders who want to avoid unexpected charges or potential fraud when using their cards outside the country. By enabling this setting, you can travel with confidence, knowing that your card is protected from unauthorized international use.

Set Spending Limits for Better Budgeting

Managing your budget has never been easier with Republic Bank's spending limit feature. Cardholders can set daily, weekly, or monthly spending limits, helping to control expenses and avoid overspending. This functionality is especially beneficial for parents managing their children's spending or individuals looking to stick to a strict budget. By setting limits, you can ensure that your financial goals remain on track.

Stay Informed with Real-Time Notifications

In addition to the control features, Republic Bank's mobile app keeps you informed with real-time notifications. Receive alerts for transactions, spending limits, and any changes made to your card settings. This immediate feedback allows you to monitor your spending habits closely and make informed financial decisions.

Conclusion: Take Charge of Your Financial Future

Republic Bank's innovative card management features provide a comprehensive solution for cardholders looking to enhance their financial control. With the ability to manage your cards directly from your mobile device, you can enjoy peace of mind knowing that your finances are secure. From instant card activation to location-based controls and spending limits, these tools empower you to take charge of your financial future. Experience the convenience and security of Republic Bank today and transform the way you manage your money.

Rate the App

User Reviews

Popular Apps

Editor's Choice