Latest Version

3.33

January 10, 2026

Innovation Finance USA LLC

Finance

Android

0

Free

com.app.quickfi

Report a Problem

More About QuickFi

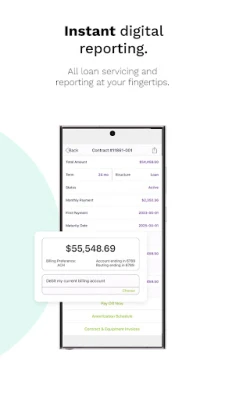

Revolutionizing SMB Financing: QuickFi's Innovative Approach

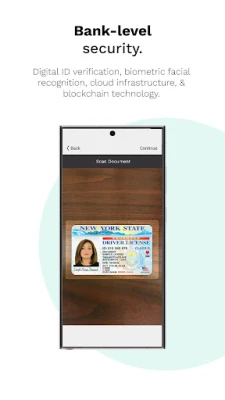

Small and medium-sized business (SMB) borrowers now have a streamlined solution for securing financing of up to $500,000. With QuickFi, the process is not only quick but also efficient, featuring nearly instant credit processing, digital documentation, and funding options available the same day or the next. This innovative platform is transforming the landscape of business equipment financing.

Instant Financing Solutions for SMBs

QuickFi offers SMBs the ability to apply for financing with unprecedented speed and convenience. The platform utilizes advanced technology to ensure that borrowers can access the funds they need without the traditional delays associated with bank loans. With just a few clicks, businesses can initiate their application and receive approval in record time.

Transforming the Business Equipment Financing Market

The U.S. business equipment financing market, valued at an impressive $1.34 trillion annually, is undergoing a significant transformation thanks to QuickFi's patented embedded lending and AI agent technology. This innovative approach not only simplifies the financing process but also enhances the overall experience for borrowers.

Cost-Effective Solutions for Banks and Manufacturers

One of the standout features of QuickFi is its cost efficiency. The platform operates at less than one-third of the cost of traditional vendor financing programs. This reduction in operational costs allows banks and manufacturers to offer more competitive rates and better service to their clients, ultimately benefiting SMB borrowers.

Why SMB Borrowers Prefer QuickFi

QuickFi has garnered a stellar reputation among SMB borrowers, reflected in its impressive TrustPilot rating of 4.8 out of 5.0. The platform's commitment to speed, transparency, and borrower convenience has made it a preferred choice for businesses seeking financing solutions. QuickFi's user-friendly interface and responsive customer service further enhance the borrowing experience.

Diverse Financing Options for Various Industries

In response to the diverse needs of SMBs, QuickFi is expanding its program offerings. The platform now includes financing options for medical, office, technology, and agricultural business equipment. This broad range of financing solutions ensures that businesses across different sectors can find the support they need to thrive.

Establish Your Digital Captive Financing Program Today

For banks and manufacturers looking to enhance their financing capabilities, QuickFi offers the opportunity to establish a digital captive financing program. By partnering with QuickFi, organizations can leverage cutting-edge technology to improve their financing processes and better serve their clients. To learn more about how QuickFi can transform your financing approach, contact them at info@quickfi.com.

In conclusion, QuickFi is at the forefront of revolutionizing SMB financing. With its innovative technology, cost-effective solutions, and commitment to borrower satisfaction, it is poised to lead the way in the business equipment financing market. Don't miss out on the opportunity to streamline your financing process—explore QuickFi today!

Rate the App

User Reviews

Popular Apps

Editor's Choice