Latest Version

5.10.03

January 27, 2026

Peoples Security Bank and Trust Company

Finance

Android

2

Free

com.peoplessecuritybank4407.mobile

Report a Problem

More About PSBT Mobile

Maximize Your Banking Experience: Manage Your Finances on the Go

In today’s fast-paced world, managing your finances efficiently is crucial. With the rise of mobile banking, you can now check your account balances, pay bills, deposit checks, and much more—all from the convenience of your mobile device. This article explores the various features of mobile banking and how they can enhance your financial management.

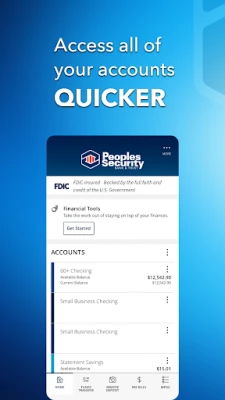

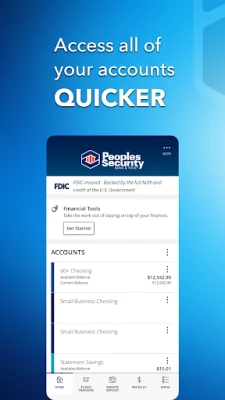

Stay Updated with Real-Time Account Balances

One of the primary advantages of mobile banking is the ability to check your account balances in real-time. Whether you’re at home, at work, or on the go, you can quickly access your financial information. This feature allows you to:

- Monitor your spending habits

- Track your savings goals

- Ensure you have sufficient funds before making purchases

By staying informed about your account balances, you can make smarter financial decisions and avoid overdraft fees.

Effortless Bill Payments

Paying bills has never been easier. With mobile banking, you can set up automatic payments or make one-time payments with just a few taps on your screen. This convenience helps you:

- Never miss a payment deadline

- Avoid late fees

- Manage multiple bills from different providers in one place

Additionally, many mobile banking apps offer reminders for upcoming bills, ensuring you stay on top of your financial obligations.

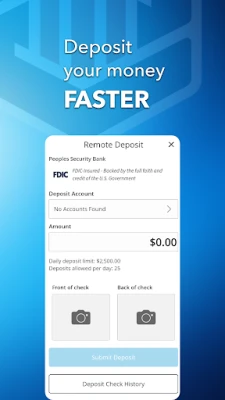

Deposit Checks Instantly

Gone are the days of visiting the bank to deposit checks. Mobile banking allows you to deposit checks instantly using your smartphone’s camera. Simply take a picture of the front and back of the check, and submit it through your banking app. This feature provides several benefits:

- Save time by avoiding trips to the bank

- Access your funds faster

- Keep track of your deposits easily

With mobile check deposit, you can manage your cash flow more effectively and ensure that your funds are available when you need them.

Enhanced Security Features

Security is a top concern for anyone managing their finances online. Mobile banking apps come equipped with advanced security features to protect your sensitive information. These include:

- Two-factor authentication

- Biometric login options (fingerprint or facial recognition)

- Real-time transaction alerts

These security measures help safeguard your accounts against unauthorized access and fraud, giving you peace of mind while banking on the go.

Budgeting and Financial Management Tools

Many mobile banking applications offer integrated budgeting tools that help you manage your finances more effectively. These tools can assist you in:

- Setting and tracking financial goals

- Creating budgets based on your spending habits

- Analyzing your financial trends over time

By utilizing these features, you can gain better control over your finances and work towards achieving your financial objectives.

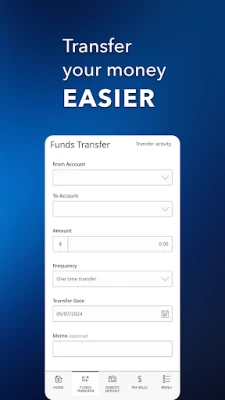

Convenient Money Transfers

Transferring money between accounts or sending money to friends and family is a breeze with mobile banking. Most apps allow you to:

- Transfer funds instantly between your accounts

- Send money to others using their email or phone number

- Schedule recurring transfers for regular payments

This convenience makes it easier to manage shared expenses or send gifts without the hassle of cash or checks.

Conclusion: Embrace the Future of Banking

Mobile banking has revolutionized the way we manage our finances. With features like real-time account balance checks, effortless bill payments, instant check deposits, enhanced security, budgeting tools, and convenient money transfers, you can take control of your financial life from anywhere. Embrace the future of banking and make the most of your mobile device to streamline your financial management today.

Rate the App

User Reviews

Popular Apps

Editor's Choice