Latest Version

12.3.0

May 03, 2025

BMO

Finance

Android

0

Free

com.bmo.business.mobile

Report a Problem

More About Online Banking for Business

Unlocking the Power of Biometric Security and Streamlined Financial Management

In today's fast-paced digital world, ensuring the security of your financial transactions while maintaining ease of access is paramount. Biometric security features and advanced financial management tools are revolutionizing how businesses handle their banking needs. This article delves into the benefits of biometric identification, cash flow monitoring, payment processing, mobile approvals, and user management, all designed to enhance your banking experience.

Enhancing Security with Biometric Identification

Biometric security is at the forefront of modern banking, providing a seamless way to verify your identity. With features like Biometric ID, you can securely sign in using your fingerprint, ensuring that only authorized users have access to sensitive financial information. This technology not only enhances security but also simplifies the login process, making it faster and more convenient.

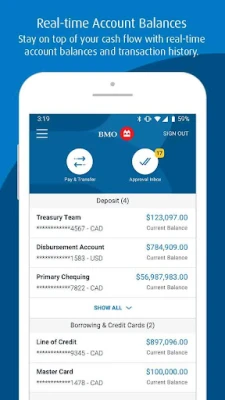

Real-Time Cash Flow Monitoring

Understanding your financial health is crucial for any business. With real-time cash flow monitoring, you can:

- Check Account Balances: Instantly view your account balances to stay informed about your financial status.

- Transaction History: Access detailed transaction histories to track your spending and income.

- Cash Flow Insights: Gain valuable insights into your cash flow patterns, helping you make informed financial decisions.

- Quick Transaction Searches: Easily search for specific transactions to streamline your financial management.

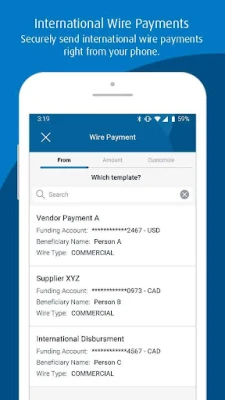

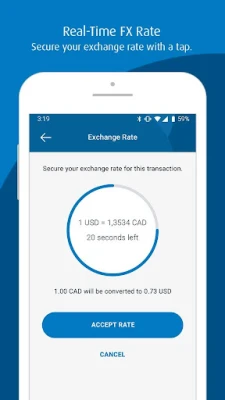

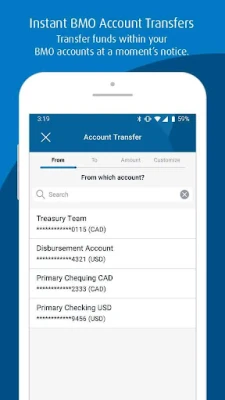

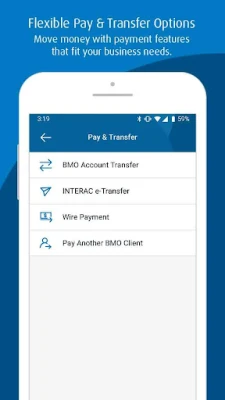

Effortless Payment Solutions

Sending and receiving payments has never been easier. With a variety of options available, you can manage your finances efficiently:

- Account Transfers: Instantly transfer money between your accounts or pay off your BMO corporate card balances.

- INTERAC® e-Transfer: Send or receive money transfers and pay requests within Canada.

- Wire Payments: Utilize your company’s beneficiary list or templates to send money globally.

- Pay Another BMO Client: Quickly deposit funds into another BMO client’s account in Canada.

- Tax & Bill Payments: Enjoy same-day processing for bills and real-time account balance updates in Canada.

- Zelle: Send payments seamlessly within the U.S.

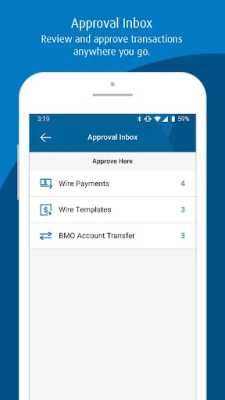

Streamlined Mobile Approvals

Managing approvals on the go is essential for busy professionals. With mobile approvals, you can:

- View Pending Approvals: Easily check all pending approvals for various services.

- Review and Approve Transactions: Approve wire payments, account transfers, and INTERAC e-Transfers directly from your app.

- Manage Electronic Funds Transfers (EFT): Review templates, payers, and payment files for corrections and resubmissions.

- Automated Clearing House (ACH): Approve templates and payments in the U.S.

- Digital Cheque Service: Make pay/return decisions for cheques in Canada.

- Real-Time Payments (RTP): Handle transactions and return requests efficiently.

- User Management: Approve new users and changes to user groups directly from your mobile device.

Efficient User Management

Managing user access is crucial for maintaining security and efficiency. With user management features, you can:

- Unlock Users: Quickly unlock user accounts when needed.

- Reset Passwords: Easily reset user passwords to ensure secure access.

Getting Started with BMO Online Banking for Business

To take advantage of these powerful features, you must be registered for BMO Online Banking for Business. Simply use the same credentials you use to log in on your computer. If you are not yet a client, visit bmo.com/main/business/online-banking-business for more information on how to get started.

Important Disclosures

By using the app, you acknowledge that it may:

- Automatically communicate with BMO’s servers to deliver the described functionalities and record usage metrics.

- Affect app-related preferences or data stored on your device.

- Collect personal information as outlined in our privacy policy. You can withdraw your consent at any time by uninstalling the app.

In conclusion, embracing biometric security and advanced financial management tools can significantly enhance your banking experience. With features designed for efficiency and security, you can focus on what truly matters—growing your business.

Rate the App

User Reviews

Popular Apps

Editor's Choice