Latest Version

March 08, 2025

National Westminster Bank PLC

Finance

Android

1

Free

com.rbs.mobile.android.natwestoffshore

Report a Problem

More About NatWest International

Unlocking the Benefits of NatWest International Mobile Banking

In today's fast-paced world, managing your finances on the go has never been easier. With NatWest International's mobile banking app, you can access your accounts, make payments, and withdraw cash—all from the convenience of your smartphone. This guide will walk you through the essential steps to get started and highlight the key features that make this app a must-have for anyone banking internationally.

Getting Started with NatWest International Mobile Banking

Before you can enjoy the benefits of mobile banking, you need to ensure you meet a few prerequisites:

- Registration for Online Banking: To use the mobile app, you must first register for NatWest's online banking services.

- Mobile Number Requirements: Ensure you have a valid mobile number from the Channel Islands, Isle of Man, UK, Gibraltar, or any supported international location.

- Your Customer Number: This is a unique identifier that consists of your date of birth followed by four random digits.

- Online Banking PIN & Password: Use your existing PIN and password to log in to the app.

- Mobile Banking Passcode: Upon your first login, you will be prompted to create a mobile banking passcode for future access.

Supported International Mobile Numbers

NatWest International supports a wide range of international mobile numbers, making it accessible for users across the globe. Here’s a list of supported countries:

- Australia

- Austria

- Bahrain

- Barbados

- Belgium

- Bermuda

- British Virgin Islands

- Canada

- Cayman Islands

- Cyprus

- Denmark

- Finland

- France

- Germany

- Gibraltar

- Greece

- Hong Kong

- Hungary

- India

- Ireland

- Italy

- Japan

- Kuwait

- Malta

- Netherlands

- New Zealand

- Norway

- Oman

- Poland

- Portugal

- Qatar

- Singapore

- South Africa

- Spain

- Sweden

- Switzerland

- UAE

- United States

Important Notes for Users

Before diving into the app's features, keep these important points in mind:

- Data Charges: Standard data charges may apply when using the app. Check with your network operator for details.

- Photosensitivity Warning: The app may display images during login that could trigger reactions in individuals with photosensitivity.

Key Features of the NatWest International Mobile Banking App

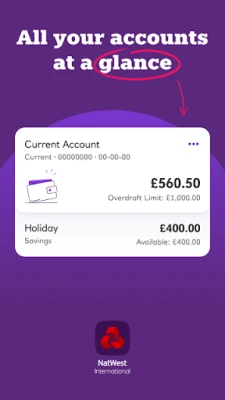

The NatWest International mobile banking app is packed with features designed to enhance your banking experience:

- Fingerprint Login: For Android users, log in effortlessly using your fingerprint, eliminating the need to remember your passcode.

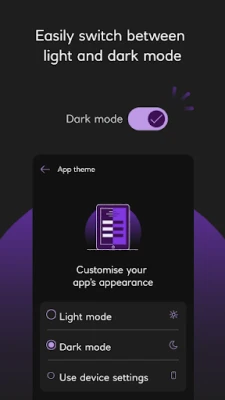

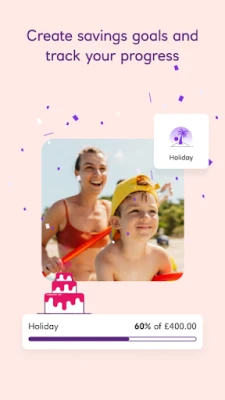

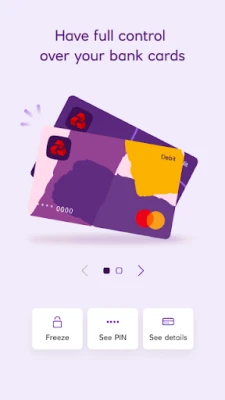

- Personalization Options: Customize your app experience by choosing how it greets you, hiding your balance, reordering accounts, managing alerts, and sharing account details.

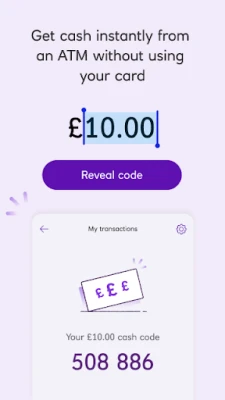

- Get Cash Feature: Withdraw up to £130 from any NatWest International, NatWest, Isle of Man Bank, Ulster Bank, or Tesco ATM without your debit card—ideal for those moments when you forget your wallet.

- Paying New Contacts: Send money to someone new without needing a card reader. Just enter their sort code and account number to transfer up to £750. For payments above this amount, register for biometric approval and use a selfie to authorize the transaction.

- Pay Contacts via Mobile Number: Easily pay your contacts using just their mobile number, streamlining the payment process.

Additional Information You Should Know

The Get Cash feature allows you to withdraw up to £130 every 24 hours, provided you stay within your daily withdrawal limit and have at least £10 available in your account. Additionally, when paying contacts, you can make a maximum of 20 payments totaling £250 per day, but you must be aged 16 or over and the recipient must have a UK current account registered for the Paym service.

By downloading the NatWest International mobile banking app, you agree to the terms and conditions, which can be found at natwestinternational.com/mobileterms. It is advisable to save or print a copy of these terms and the privacy policy for your records.

Conclusion

NatWest International's mobile banking app offers a comprehensive suite of features that make managing your finances easier than ever. With secure login options, personalized settings, and convenient payment methods, you can take control of your banking experience from anywhere in the world. Download the app today and unlock the full potential of your banking needs.

Rate the App

User Reviews

Popular Apps

Editor's Choice