Latest Version

1.5.30301

December 25, 2025

Safeway Information Systems

Finance

Android

0

Free

com.mysafeway.app

Report a Problem

More About MySafeway

Understanding Your Insurance: Policy Status, Payment History, and Vehicle Details

When it comes to managing your insurance, three critical components play a significant role: policy status, payment history, and vehicle details. Understanding these elements can help you make informed decisions and ensure that you are adequately covered. This article delves into each aspect, providing clarity and guidance for policyholders.

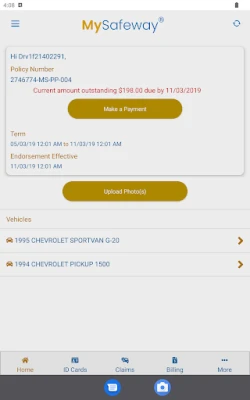

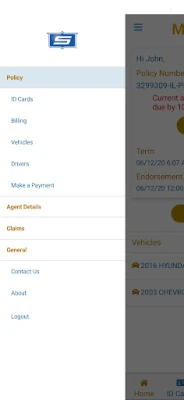

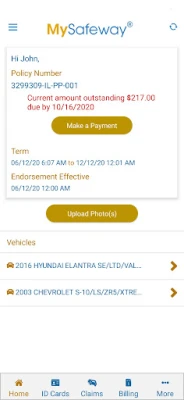

1. Policy Status: Keeping Track of Your Coverage

Your policy status is a vital indicator of your insurance coverage. It reflects whether your policy is active, expired, or in a grace period. Regularly checking your policy status can prevent lapses in coverage that could leave you vulnerable in case of an accident or claim.

To check your policy status, you can:

- Log into your insurance provider's online portal.

- Contact customer service for real-time updates.

- Review your policy documents for renewal dates and terms.

Staying informed about your policy status not only ensures that you maintain continuous coverage but also helps you understand any changes in your premiums or terms. If you notice discrepancies or have questions, reach out to your insurer promptly.

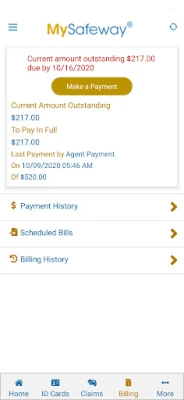

2. Payment History: Tracking Your Financial Commitment

Your payment history is a record of all the payments you have made towards your insurance policy. This history is crucial for several reasons:

- Establishing Trust: A consistent payment history demonstrates your reliability as a policyholder, which can positively influence your insurer's willingness to offer discounts or favorable terms in the future.

- Claim Processing: In the event of a claim, your payment history can serve as proof of your active coverage, ensuring that your claims are processed without unnecessary delays.

- Budgeting: Keeping track of your payment history helps you manage your finances effectively, allowing you to plan for future payments and avoid lapses in coverage.

To maintain an accurate payment history, consider the following tips:

- Set up automatic payments to avoid missed deadlines.

- Regularly review your bank statements to ensure all payments are processed correctly.

- Keep records of all payment confirmations for your reference.

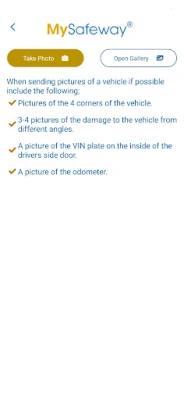

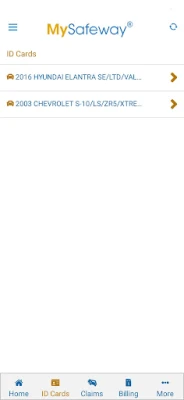

3. Vehicle Details: Essential Information for Coverage

Your vehicle details are crucial for determining your insurance coverage and premiums. Insurers require specific information about your vehicle to assess risk accurately. Key details include:

- Make and Model: The type of vehicle you own can significantly impact your insurance rates. High-performance cars may attract higher premiums due to their increased risk of accidents.

- Year of Manufacture: Newer vehicles often come with advanced safety features, which can lower your insurance costs. However, they may also be more expensive to repair or replace.

- Vehicle Identification Number (VIN): This unique code helps insurers track your vehicle's history, including any accidents or thefts, which can influence your coverage options.

To ensure you have the right coverage for your vehicle, keep your information up to date. Notify your insurer of any changes, such as modifications, new purchases, or sales. This proactive approach can help you avoid potential issues when filing a claim.

Conclusion: Stay Informed and Protected

Understanding your policy status, payment history, and vehicle details is essential for effective insurance management. By staying informed about these aspects, you can ensure that you maintain adequate coverage, manage your finances wisely, and protect your investment in your vehicle.

Regularly review your insurance documents, communicate with your insurer, and keep your information updated. This diligence will not only enhance your peace of mind but also empower you to make informed decisions regarding your insurance needs.

Rate the App

User Reviews

Popular Apps

Editor's Choice