Latest Version

4.0.0.Free

November 24, 2025

Vitaliy Panov

Finance

Android

0

Free

vitalypanov.personalaccounting.free

Report a Problem

More About Money Manager

Master Your Finances: Optimize Costs and Boost Savings with Personal Finance Apps

In today's fast-paced world, managing personal finances can often feel overwhelming. Many individuals struggle to identify their financial strengths and weaknesses, leading to unnecessary expenses and missed savings opportunities. Fortunately, a personal finance app can simplify this process, allowing you to take control of your budget effectively. This article explores how a personal finance application can help you optimize costs, increase revenues, and improve your monthly balance.

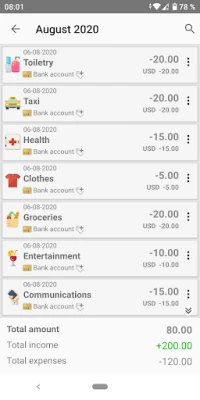

Understanding Your Financial Landscape

Before diving into budgeting tools, it's essential to understand your current financial situation. Many people find themselves asking, "Where does my money go?" A personal finance app provides a straightforward solution to track and manage your expenses. By utilizing this tool, you can gain insights into your spending habits and identify areas for improvement.

Why Choose a Personal Finance App?

If you've ever attempted to manage your finances using an Excel spreadsheet or a handwritten notebook, you may have found it tedious and easy to abandon. A personal finance app offers a user-friendly interface that makes tracking your budget simple and efficient. With instant access to your financial data, you can create a balanced budget that aligns with your financial goals.

Achieving Your Financial Goals

Are you struggling to save for a vacation, a new car, or any significant purchase? A personal finance app can help you reach these goals faster. By recording your daily expenses, you can quickly identify weaknesses in your budget and implement strategies to save more effectively. Consistent use of the app will empower you to make informed financial decisions and stay on track toward your objectives.

Features of the Personal Finance App

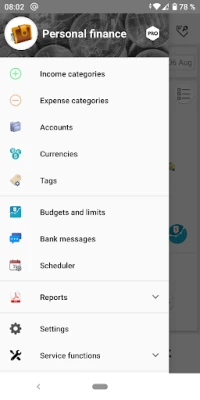

The free version of the personal finance app includes essential functions for effective cost accounting. However, for those seeking advanced features, the Pro version offers a comprehensive suite of tools designed to enhance your financial management experience.

Multi-Currency Accounting

For individuals dealing with multiple currencies, the app allows you to create and manage accounts in various currencies. This feature enables you to monitor the total values of all accounts in a single base currency, simplifying your financial overview.

Unlimited Accounts

With the Pro version, you can create and manage as many accounts as you need. This flexibility allows you to categorize your finances more effectively and assign any available currencies to your accounts.

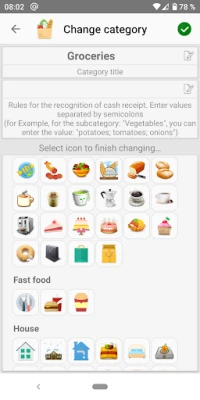

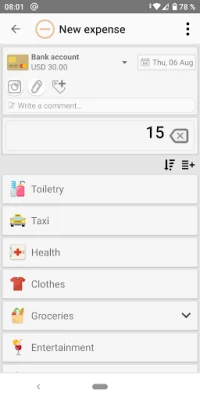

Custom Income and Expense Categories

The app lets you add new income and expense categories, complete with customizable icons. This feature helps you tailor your financial tracking to your specific needs, making it easier to visualize your spending patterns.

Budgets and Spending Limits

Establishing budgets is crucial for effective financial management. The app allows you to create multiple budgets, enabling you to control your finances more efficiently and stay within your spending limits.

Automated SMS Parsing

Say goodbye to manual data entry! The app's SMS parsing feature allows you to create rules for processing bank SMS messages. This automation ensures that your transactions are recorded accurately without requiring your constant attention.

QR Code Scanning

With the QR voucher barcode feature, you can scan receipts directly from your phone. This functionality streamlines expense tracking, allowing you to log purchases instantly while shopping.

Widgets for Quick Access

The app includes widgets that you can add to your phone's home screen. This feature provides quick access to essential financial information and frequently used functions, keeping your budget at your fingertips.

Dark Theme for Comfort

For those who prefer a more visually comfortable experience, the app offers a dark theme. This option reduces screen brightness, minimizes eye strain, and enhances usability in low-light conditions while also conserving battery life.

Enhanced Security Features

Your financial data's security is paramount. The app allows you to set a password and security question to protect your information. Additionally, fingerprint authentication provides a quick and secure way to access your account, ensuring that your data remains safe.

Backup and Restore Functionality

Transitioning between the free and Pro versions of the app is seamless, thanks to the backup and restore feature. If you have existing transactional data in the free version, you can easily transfer it to the Pro version without losing any information.

Conclusion: Take Control of Your Financial Future

In conclusion, a personal finance app is an invaluable tool for anyone looking to optimize their financial management. By identifying weaknesses in your budget, tracking expenses, and setting achievable goals, you can take charge of your financial future. Whether you choose the free version or upgrade to the Pro version, the features available will empower you to make informed decisions and achieve your financial aspirations. Start your journey toward financial stability today!

Rate the App

User Reviews

Popular Apps

Editor's Choice