Latest Version

4.9.2

February 25, 2025

Everlance

Finance

Android

0

Free

com.everlance

Report a Problem

More About Mileage Tracker by Everlance

Maximize Your Savings with Everlance: The Ultimate Mileage and Expense Tracking Solution

In today's fast-paced world, managing your business finances efficiently is crucial for success. Everlance offers a comprehensive solution for self-employed individuals and business owners, ensuring you never miss a deduction. This article explores the key features of Everlance, highlighting how it can transform your financial management and maximize your savings.

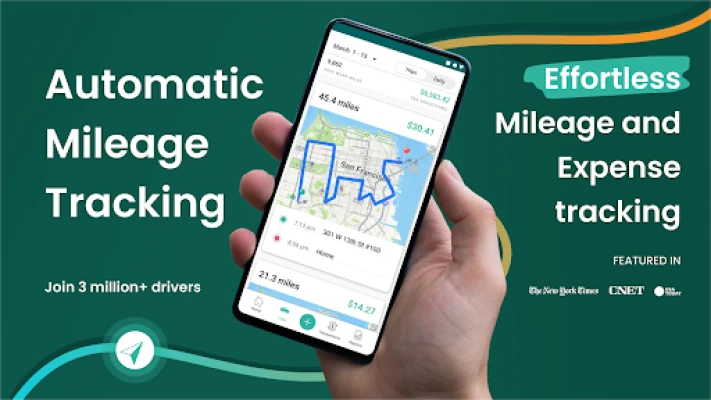

Automatic Mileage Tracking: Focus on Your Work

Everlance simplifies your life with its automatic mileage tracking feature. The app runs seamlessly in the background, recording every mile you drive without requiring you to start or stop a tracker. This means you can concentrate on your work, knowing that your mileage is being accurately logged. Whether you're driving for rideshare, delivery, or your own business, Everlance ensures that every mile counts.

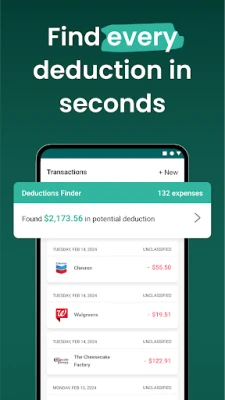

Effortless Expense Logging: Stay Organized

Keeping track of business expenses can be a daunting task, but Everlance makes it easy. With the ability to log expenses effortlessly, you can snap photos of your receipts and categorize them alongside your mileage. This feature not only helps you stay organized but also maximizes your deductions, allowing you to uncover hidden savings that can significantly lower your taxable income.

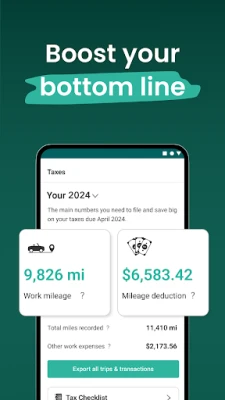

Maximize Your Tax Deductions: Save More

By accurately tracking your mileage and expenses, Everlance enables you to maximize your tax deductions. Users can save up to $6,500 annually by utilizing IRS-compliant reports generated by the app. This powerful feature ensures that you are well-prepared for tax season, making it easier to file your taxes and claim your deductions.

Stay IRS-Compliant: Simplify Tax Filing

Filing taxes can be stressful, but Everlance takes the hassle out of the process. The app allows you to generate IRS-compliant reports effortlessly, making tax filing and mileage reimbursement straightforward and stress-free. With all your data organized in one place, you can approach tax season with confidence.

Designed for On-the-Go Professionals

Everlance is specifically built for on-the-go professionals. Whether you are a rideshare driver, delivery person, or a small business owner, the app is equipped with time-saving features that cater to your unique needs. With Everlance, you can ensure that every mile you drive contributes to your bottom line.

Top-Notch Security: Your Data is Safe

Security is a top priority for Everlance. The app employs 256-bit encryption and is SOC-2 certified, ensuring that your information is protected to the highest standards. Everlance is committed to your privacy, never sharing or selling your data, and advocates for stronger security practices across the industry.

Unlock More with Everlance Professional

For those looking to take their self-employment journey to the next level, Everlance Professional offers powerful tools designed to manage every aspect of your business finances. With this premium version, you can:

- Track Mileage: Automatically log every mile for seamless deductions and maximize your savings.

- Track Expenses: Effortlessly log expenses and uncover hidden deductions to lower your taxable income.

- File Taxes: File federal and state taxes directly within the app, with all necessary forms included at no extra cost.

- Audit Protection: Enjoy peace of mind with $1 million in audit defense services, keeping you protected year-round.

Let Everlance Professional handle the details, allowing you to focus on growing your business and enhancing your tax strategy.

Track Every Mile with Confidence

With Everlance, you can confidently track your mileage and expenses throughout the year. Whether for tax deductions or business reimbursements, the app ensures that no mile goes unaccounted for. With accurate mileage tracking, detailed reports, and automated features, you will never miss an opportunity to maximize your savings.

Start your journey with Everlance today and unlock your full earning potential. Experience the ease of managing your business finances and watch your savings grow.

Exceptional Customer Support

Everlance is dedicated to providing top-notch customer support. Whether you need assistance in English, Spanish, or French, the support team is ready to help. Reach out via email at support@everlance.com for any inquiries or assistance you may need.

In conclusion, Everlance is more than just a mileage and expense tracking app; it is a comprehensive financial management tool that empowers self-employed individuals and business owners to maximize their savings and streamline their financial processes. Don't miss out on the opportunity to enhance your financial management—try Everlance today!

Rate the App

User Reviews

Popular Apps

Editor's Choice