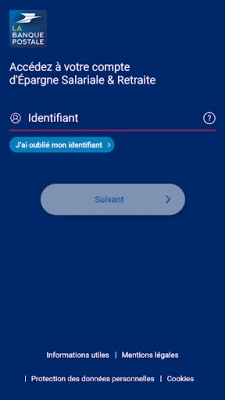

Latest Version

5.0.0

April 25, 2025

La Banque Postale

Finance

Android

0

Free

fr.labanquepostale.epargnesalariale

Report a Problem

More About La Banque Postale ERE

Maximize Your Savings: A Comprehensive Guide to Managing Your Investment Portfolio

In today's fast-paced financial landscape, effectively managing your savings and investments is crucial. This guide will help you visualize your savings, track your assets, and stay informed about your investment options. Whether you're looking to manage your account or simply want to stay updated, this article covers everything you need to know.

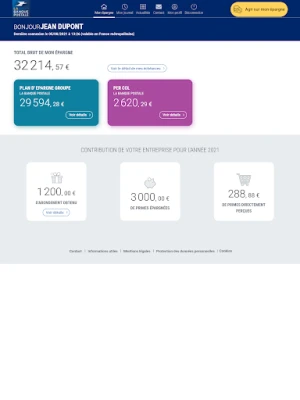

Visualize Your Savings at a Glance

Understanding your savings is the first step towards effective financial management. With the right tools, you can:

- View Detailed Savings by Product and Fund: Gain insights into how your savings are allocated across various products and funds. This overview allows you to make informed decisions about your investments.

- Track Asset Growth and Available Savings: Monitor the evolution of your assets over time. Keeping an eye on your available savings helps you plan for future investments and expenditures.

- Stay Informed About Your Investment Funds: Learn about the risk levels, recommended investment durations, performance metrics, and relevant documentation for each fund in your portfolio. This knowledge empowers you to make strategic investment choices.

Effortlessly Manage Your Account

Managing your investment account should be straightforward and efficient. Here are some key actions you can take:

- Quickly Respond to Profit-Sharing Bonuses: When you receive bonuses from profit-sharing or participation plans, you can respond swiftly and easily. This ensures you capitalize on opportunities as they arise.

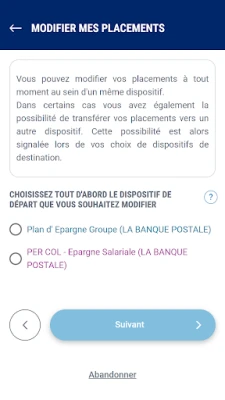

- Modify Investment Choices: Flexibility is essential in investment management. You can change your investment preferences and transfer your savings from one fund to another or switch between different products as needed.

- Make One-Time and Scheduled Contributions: Whether you want to make a lump-sum investment or set up regular contributions, managing your payments is simple. You can also request withdrawals when necessary, ensuring you have access to your funds when you need them.

Stay Informed About Your Investments

Knowledge is power in the world of investments. To stay ahead, consider the following:

- Read Important Information Messages: Regularly check for updates and messages related to your investments. Staying informed helps you make timely decisions and adapt to market changes.

- Consult Regulatory Guidelines: Understanding the regulations that govern your investments is crucial. Familiarize yourself with the rules and guidelines to ensure compliance and protect your interests.

Conclusion: Take Control of Your Financial Future

Managing your savings and investments doesn't have to be overwhelming. By visualizing your savings, efficiently managing your account, and staying informed, you can take control of your financial future. Utilize the tools and resources available to you, and make informed decisions that align with your financial goals. Start today and watch your investments grow!

Rate the App

User Reviews

Popular Apps

Editor's Choice