Latest Version

9.8.0

April 14, 2025

ING Australia

Finance

Android

0

Free

au.com.ingdirect.android

Report a Problem

More About ING Australia Banking

Unlocking the Power of Your Orange Everyday Card: Key Features and Benefits

In today's fast-paced digital world, managing your finances efficiently is more important than ever. The Orange Everyday card from ING offers a suite of features designed to enhance your banking experience. From seamless payments to robust security measures, this card is tailored to meet your financial needs. Let’s explore the key features and additional benefits that make the Orange Everyday card a must-have for savvy savers.

Seamless Payments with Google Pay

One of the standout features of the Orange Everyday card is its compatibility with Google Pay. This allows you to make quick and secure payments directly from your phone. Simply link your Orange Everyday card to Google Pay, and you can enjoy the convenience of contactless transactions at your favorite retailers. No more fumbling for cash or cards—just tap and go!

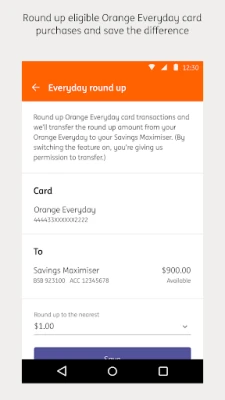

Accelerate Your Savings with Round-Up Transactions

Saving money has never been easier with the round-up feature. When you make eligible purchases, you can opt to round up the transaction amount to the nearest dollar. The difference is automatically transferred to your savings account, helping you build your savings faster without even thinking about it. This feature is perfect for those who want to save effortlessly while managing their daily expenses.

Stay Informed with the ING Widget

Keeping track of your finances is crucial, and the ING Widget makes it simple. With this feature, you can view your account balances at a glance without needing to log in. This real-time access to your financial information helps you stay on top of your spending and savings goals, ensuring you always know where you stand financially.

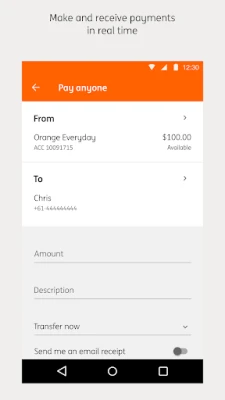

Real-Time Payments with NPP

The Orange Everyday card also supports NPP Payments, allowing you to make real-time payments with eligible accounts. This feature ensures that your transactions are processed instantly, providing you with greater flexibility and control over your finances. Whether you’re paying bills or sending money to friends, you can do it all in real-time.

Manage Your Finances with Ease

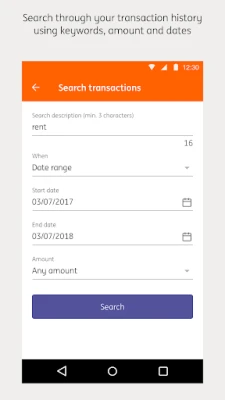

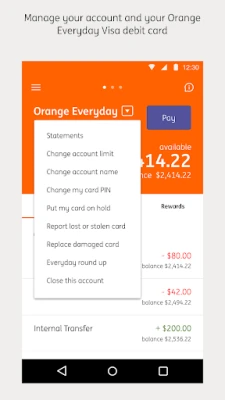

With the Orange Everyday card, managing your finances is a breeze. You can easily:

- Change your Pay Anyone limit to suit your needs.

- Track your benefits and rebates to maximize your savings.

- Check the balances of your favorite accounts without logging in, making it easier to monitor your financial health.

- View and share your statements effortlessly, keeping your financial records organized.

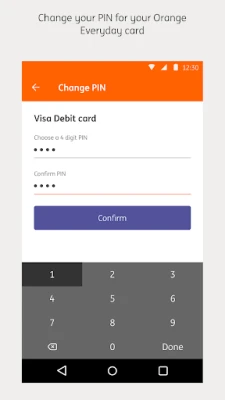

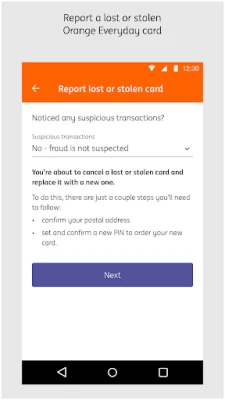

- Change your card PIN, place your card on hold, or report a lost or stolen card directly from the app.

- Find the nearest Bank@Post location by suburb or postcode, ensuring you have access to banking services when you need them.

Understanding Terms of Use and Security

Before diving into the features of the Orange Everyday card, it’s essential to familiarize yourself with the terms of use and security policies. These guidelines govern your use of the mobile application and ensure that your banking experience is safe and secure. Always stay informed about the latest security measures to protect your financial information.

Important Considerations

While the Orange Everyday card offers a plethora of features, it’s important to note that normal data charges may apply when using the mobile banking app. Check with your mobile service provider for details. Additionally, not all internet banking features are available through the app, so be sure to understand any limitations that may affect your banking experience.

ING is a business name of ING Bank (Australia) Limited, and it operates under the ABN 24 000 893 292 and AFSL 229823. This ensures that you are banking with a reputable institution that prioritizes your financial security.

Conclusion: Elevate Your Banking Experience

The Orange Everyday card from ING is more than just a banking tool; it’s a comprehensive financial solution designed to simplify your life. With features like Google Pay integration, round-up savings, and real-time payments, you can take control of your finances like never before. Embrace the future of banking and unlock the full potential of your Orange Everyday card today!

Rate the App

User Reviews

Popular Apps

Editor's Choice