Latest Version

2.27

March 09, 2025

IDFC FIRST Bank Ltd.

Finance

Android

0

Free

com.idfcfirstbank.optimus

Report a Problem

More About IDFC FIRST Bank: MobileBanking

Unlock the Future of Banking with IDFC FIRST Bank Mobile App

In today's fast-paced world, managing your finances efficiently is crucial. The IDFC FIRST Bank Mobile App offers a seamless banking experience that combines convenience, security, and innovative features. Discover how this app can transform your banking experience and help you achieve your financial goals.

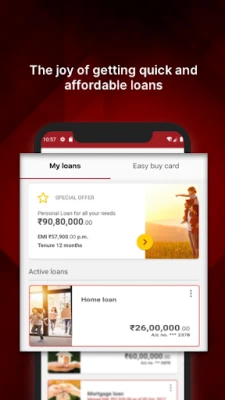

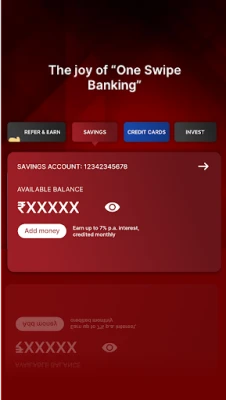

One-Swipe Banking: Effortless Account Management

With the IDFC FIRST Bank Mobile App, you can access your account balances and manage your credit and debit card details with just a single swipe. Whether you want to check your deposits, investments, or transaction history, everything is at your fingertips. This user-friendly interface ensures that you can manage your finances without any hassle.

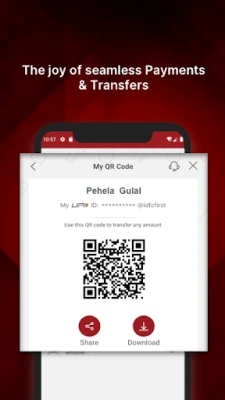

Instant Payments & Transfers: Secure and Fast

Make secure payments and transfers instantly with the app. Whether it's UPI transfers or bill payments, the app ensures that your transactions are processed quickly and securely. Enjoy the peace of mind that comes with knowing your money is safe while you manage your finances on the go.

Zero Fee Banking: Cost-Effective Financial Solutions

Experience the benefits of zero-fee banking with IDFC FIRST Bank. Enjoy free savings account services, including money transfers, cheque re-issuance, debit card issuance, and ATM withdrawals. This cost-effective approach allows you to save more while managing your finances efficiently.

Expense Tracking: Stay on Top of Your Finances

Monitor your cash flow effortlessly with the app's expense tracking feature. With over 20 automatically categorized transaction types, you can gain insights into your spending habits. Link your FIRST WOW! and Digital Rupay Credit Card with UPI to earn cashback and rewards on every payment, making your financial management even more rewarding.

Auto-Sweep Current Accounts: Maximize Your Earnings

Take advantage of the BRAVO Current Accounts with Auto-Sweep features that transfer excess funds to fixed deposits (FD) for higher interest rates. This smart feature ensures that your money works harder for you, helping you build wealth over time.

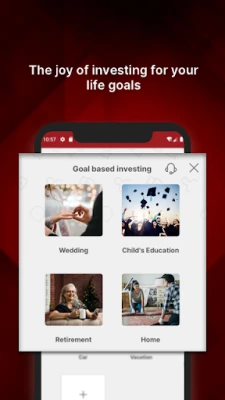

Investment Portfolio: Simplified Wealth Building

View your entire investment portfolio on a single screen. The app provides curated investment recommendations tailored to your risk profile, making it easier for you to make informed decisions and grow your wealth.

Personalized Offers: Exclusive Deals Just for You

Enjoy exciting offers across various categories, including dining, lifestyle, and travel. The app curates personalized deals that enhance your banking experience and provide additional value.

Instant Personal Loans: Quick and Convenient Financing

Need quick cash? The app offers pre-approved personal loan options at attractive interest rates and flexible tenures. Whether you need funds for an emergency or a planned expense, the IDFC FIRST Bank Mobile App makes it easy to access the financial support you need.

Fixed Deposits: Secure Your Future

Open a fixed deposit in just three quick steps. Invest online and enjoy guaranteed returns, ensuring that your savings grow steadily over time.

Smart App Features and Services

1. Secure Fund Transfers & Payments

- Free fund transfers to any bank account without adding a beneficiary.

- Easy bill payments and recharges for mobile, DTH, and utility bills.

- Earn up to 10X rewards on travel and shopping spends via credit cards, redeemable for exclusive discounts.

- Three-click digital bill payments for added convenience.

- Zero fee money transfers to bank accounts through IMPS, NEFT, or RTGS.

- Send money, pay utility and credit card bills, and buy/recharge FASTag using UPI.

- Link bank accounts and view your savings account balances with UPI.

2. Investment, Mutual Funds & IPOs App

Explore a range of online investment services:

- Invest in mutual funds online with Instant SIP.

- Choose from equity, debt, large-cap, and multi-cap investments.

- Save on taxes with ELSS mutual funds.

- Invest in Unit Linked Insurance Plans (ULIP) and Online Sovereign Gold Bonds.

3. Insurance App

Purchase health, bike, and car insurance directly through the app, ensuring that you have the coverage you need at your fingertips.

4. Tripstacc Benefits

- Enjoy a convenient in-app flight and hotel booking experience powered by Tripstacc.

- No convenience fees on flight bookings and earn 20 bonus points for every ₹100 spent on hotel bookings.

5. Other Banking Services

- Apply for a debit card and cheque book via the app with no charges.

- View filtered transactions and download Smart Statements + Digest.

- Manage credit card payments, download statements, and redeem credit card rewards.

- Quickly purchase and recharge FASTag.

- No fees on DD and pay order issuance, as well as third-party withdrawals.

- No ECS return fee and no decline fee at ATMs for low funds.

- Receive personalized offers across loans.

- One app login for retail, MSME, customer service, and relationship management.

Steps to Download the App & Open a Digital Banking Account

- Download the banking app and click on "Open Savings Account."

- Register your details to receive your user ID and password.

- Log in using your user ID and password or mobile number and MPIN.

- Set up Face ID or fingerprint scanner for easy log-in.

- Utilize the SIM Binding feature for secure banking.

Personal Loan Features: Flexible Financing Options

Explore the personal loan offerings:

- Loan amount: ₹20,000 to ₹40 lakhs.

- Loan tenure: 6 to 60 months.

- Annual Percentage Rate: 11% to 28%.

Representative Example:

- Loan amount: ₹1,00,000

- Loan tenure: 12 months

- Interest rate (reducing): 20%

Rate the App

User Reviews

Popular Apps

Editor's Choice