Latest Version

3.52.12

February 20, 2025

HSBC

Finance

Android

0

Free

sg.com.hsbc.hsbcsingapore

Report a Problem

More About HSBC Singapore

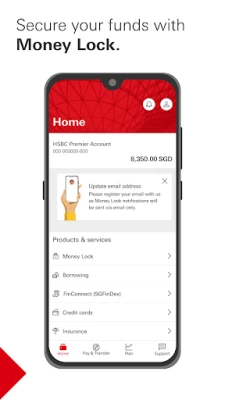

Unlock Seamless Banking with the HSBC Singapore App

In today's fast-paced world, managing your finances should be as effortless as possible. The HSBC Singapore App offers a comprehensive suite of features designed to enhance your banking experience, all from the convenience of your mobile device. Whether you're looking to open an account, manage investments, or make quick payments, this app has you covered. Here’s a detailed look at what you can do with the HSBC Singapore App.

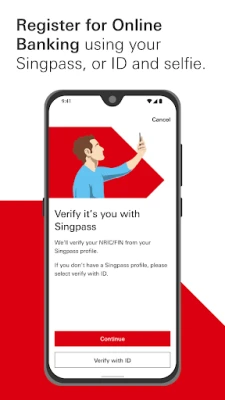

Effortless Online Banking Registration

Getting started with online banking has never been easier. With the HSBC Singapore App, you can register for an online banking account directly from your mobile device. All you need is your Singpass app or a valid photo ID (NRIC, MyKad, or passport) along with a selfie for verification. This streamlined process ensures that you can access your banking services quickly and securely.

Enhanced Security with Digital Secure Key

Security is paramount in online banking. The app features a Digital Secure Key that generates a unique security code for your transactions. This means you can perform online banking activities without the hassle of carrying a physical security device, ensuring your information remains protected at all times.

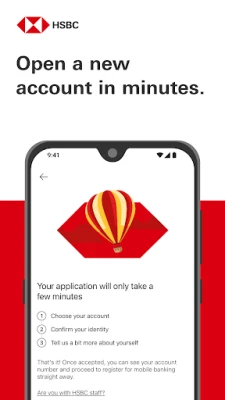

Instant Account Opening

Need a bank account in a hurry? The HSBC Singapore App allows you to open a bank account in just minutes. Enjoy the benefits of instant online banking registration. If you can't complete your application in one go, don’t worry—you can easily resume it at your convenience.

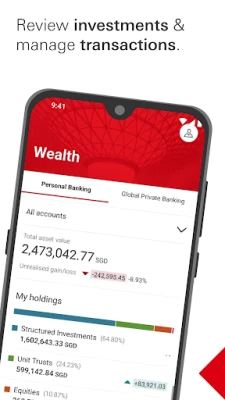

Quick Investment Account Setup

For eligible customers, the app offers an instant investment account opening feature. With just a few taps, you can access a variety of investment options, including equities in Singapore, Hong Kong, and the United States, as well as unit trusts, bonds, and structured products. The app simplifies the investment process, allowing you to make informed decisions quickly.

Seamless Securities Trading

Experience the thrill of securities trading from anywhere. The HSBC Singapore App provides you with the tools to trade securities on the go, ensuring you never miss out on lucrative opportunities in the market.

Mobile Wealth Dashboard

Stay on top of your investments with the mobile wealth dashboard. This feature allows you to review your investment performance effortlessly, giving you insights into your financial health at a glance.

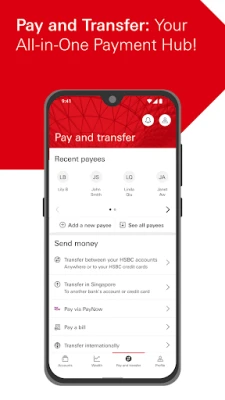

Global Money Transfers Made Easy

Managing international payments is a breeze with the app's global money transfer capabilities. You can easily manage your international payees and perform timely transfers, ensuring your funds reach their destination reliably and conveniently.

Instant Payments with PayNow

Send money instantly using PayNow. This feature allows you to share payment receipts using just a mobile number, NRIC, Unique Entity Number, or Virtual Payment Address, making transactions quick and hassle-free.

Scan to Pay Convenience

Paying your friends or shopping at participating merchants is as simple as scanning a QR code. The Scan to Pay feature enables you to settle bills effortlessly, enhancing your shopping experience across Singapore.

Efficient Transfers Management

With the app, you can set up, view, and delete future-dated and recurring domestic transfers. This transfers management feature ensures that your payments are organized and timely, giving you peace of mind.

Streamlined Payee Management

Manage your payees efficiently with the app's one-stop solution for payee management. Add new billers and make payments securely anytime and anywhere, simplifying your financial transactions.

Access to eStatements

Stay organized by viewing and downloading up to 12 months of both credit card and banking account eStatements. This feature allows you to keep track of your financial history with ease.

Instant Card Activation

Activate your new debit and credit cards instantly through the app. Start using your cards immediately without the wait, making your banking experience more efficient.

Report Lost or Stolen Cards

In the unfortunate event of losing your card, you can report lost or stolen debit and credit cards and request replacements instantly. The app ensures that your banking remains secure, even in emergencies.

Block or Unblock Your Cards

Need to temporarily block your card? The app allows you to block or unblock your debit and credit cards with just a few taps, providing you with control over your finances.

Balance Transfer Options

Take advantage of the balance transfer feature to convert your available credit limit into cash. This can help you pay off dues with other banks or provide you with funds for your needs.

Flexible Spending with Instalments

Apply for Spend Instalment plans to repay your purchases in manageable monthly instalments. This feature allows you to budget effectively while enjoying your purchases.

Rewards Programme Tailored to You

Make the most of your spending with the app's rewards programme. Redeem credit card rewards that align with your lifestyle, from the latest gadgets to airline miles and hotel points.

Virtual Card for Immediate Use

Need to shop online before your physical card arrives? The app provides a virtual card feature, allowing you to view your credit card details and start spending immediately.

Connect with Customer Support

Have questions or need assistance? The app allows you to chat with customer support on the go, ensuring you receive help whenever you need it.

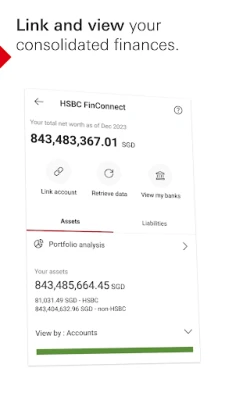

Comprehensive Financial Overview with FinConnect

Utilize FinConnect (SGFinDex) to view your personal financial data securely, including information from other banks, all within the HSBC Singapore app. This feature provides a holistic view of your finances.

Update Your Personal Details

Keep your contact information up to date by easily updating your phone number and email address within the app. This ensures seamless communication and service from your bank.

Download the HSBC Singapore App now to enjoy the convenience of digital banking at your fingertips!

Important: This app is designed for use in Singapore. The products and services represented within this app are intended for Singapore customers. HSBC Bank (Singapore) Limited is authorized and regulated in Singapore

Rate the App

User Reviews

Popular Apps

Editor's Choice