Latest Version

3.2.0

February 23, 2025

Gusto, Inc.

Finance

Android

0

Free

com.gusto.money

Report a Problem

More About Gusto Mobile

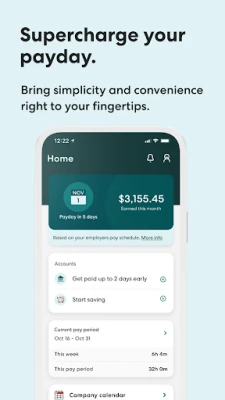

Unlock Your Financial Future with Gusto Wallet: The Ultimate Guide

In today's fast-paced world, managing your finances efficiently is more crucial than ever. Gusto Wallet offers a comprehensive solution that empowers you to earn, save, and spend directly from your Gusto account. This innovative platform is designed to help you take control of your financial future with ease and convenience.

Get Paid Early with Gusto Spending Account

One of the standout features of Gusto Wallet is the ability to receive your paycheck up to two days early. With a Gusto spending account, you can access your funds sooner than traditional banking methods allow. This early access to your earnings can provide significant relief, especially during tight financial times. Keep in mind that the timing of your payment depends on when your employer processes the payment funds.

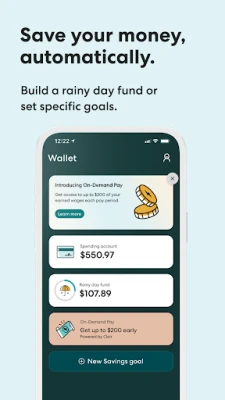

Save Towards Your Goals with Autosave

Gusto Wallet makes saving effortless with its autosave feature. You can set custom savings goals and watch your money grow without lifting a finger. Whether you're saving for a vacation, a new gadget, or an emergency fund, Gusto's autosave functionality helps you stay on track and reach your financial objectives faster.

No Hidden Fees: Enjoy Financial Freedom

With Gusto Wallet, you can enjoy the peace of mind that comes with no minimum balances, account fees, or overdraft fees. This transparency allows you to manage your finances without worrying about unexpected charges. However, be aware that some fees may apply for out-of-network ATM withdrawals and foreign transactions, so it's essential to review the terms and conditions carefully.

Simple Spending with Gusto Debit Card

The Gusto debit card simplifies your spending experience. With this card, you can make purchases directly from your Gusto account, making it easier to manage your budget. The Gusto debit card is a convenient tool for everyday transactions, ensuring that you have quick access to your funds whenever you need them.

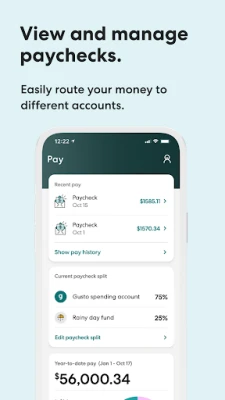

Effortless Cash Management with Paycheck Splitter

Gusto Wallet also features a paycheck splitter, allowing you to route your cash efficiently. This tool enables you to allocate portions of your paycheck to different savings goals or spending categories, helping you manage your finances more effectively. By splitting your paycheck, you can ensure that your financial priorities are met without any hassle.

Stay Organized: View Paychecks and Tax Documents Easily

Keeping track of your financial documents is crucial for effective money management. Gusto Wallet allows you to easily view your paychecks and tax documents in one place. This feature not only helps you stay organized but also simplifies tax season, making it easier to file your returns accurately and on time.

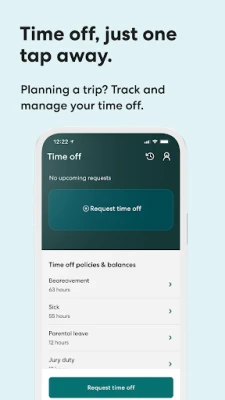

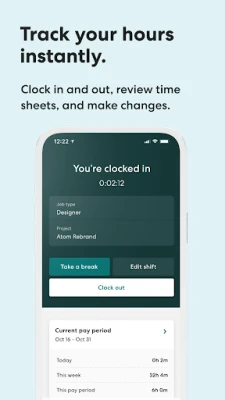

Time Management Made Simple: Clock In and Out Instantly

For those who are self-employed or work hourly jobs, Gusto Wallet offers a convenient time management feature. You can clock in and out, review timesheets, and manage your work hours instantly. This functionality ensures that you are accurately compensated for your time, making it easier to keep track of your earnings.

Important Legal Information

While Gusto Wallet offers numerous benefits, it's essential to understand the legal aspects associated with its services. The Gusto spending account allows for early payment processing, but the timing is contingent on your employer's actions. Additionally, while Gusto provides a range of financial services, it is not a bank. The Gusto savings goals, spending account, and debit card are issued by nbkc bank, Member FDIC.

Funds held in your Gusto spending account are insured up to $250,000 per depositor through nbkc bank. However, Gusto itself is not FDIC-insured. If you have joint accounts, those funds are separately insured for up to $250,000 for each account owner. It's important to note that nbkc bank utilizes a deposit network service, which means that your funds may be placed in other insured depository institutions. For more information on where your funds may be held, visit this link.

For those interested in on-demand pay, Gusto Wallet partners with Clair, a financial services company that provides advances on your earnings. Keep in mind that all advances are subject to eligibility criteria and application review, and terms and conditions apply.

Conclusion: Take Charge of Your Financial Future with Gusto Wallet

Gusto Wallet is a powerful tool that simplifies financial management, allowing you to earn, save, and spend with confidence. With features like early payment access, autosave, and a user-friendly debit card, Gusto Wallet is designed to help you achieve your financial goals. By understanding the legal aspects and utilizing the available tools, you can take control of your financial future today.

Rate the App

User Reviews

Popular Apps

Editor's Choice