Latest Version

7.2.1

April 25, 2025

Grow Credit Inc.

Finance

Android

0

Free

com.growcredit.prod

Report a Problem

More About Grow Credit

Boost Your Credit Score with Grow: A Comprehensive Guide

Your credit score varies across the three major credit bureaus: Experian, Equifax, and TransUnion. A robust score on all three is crucial, as mortgage lenders, car dealerships, and credit card companies often assess multiple scores to evaluate your creditworthiness. Grow Credit offers a streamlined solution to enhance your credit score efficiently across all three bureaus.

How to Elevate Your Credit Score with Grow in Three Simple Steps

Improving your credit score has never been easier. Follow these three straightforward steps to get started with Grow:

- Apply for a Grow Credit Membership.

- Link your bank account.

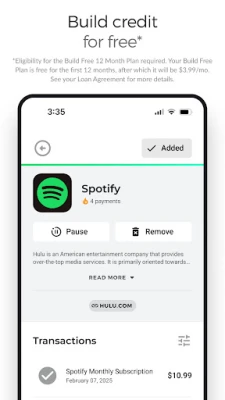

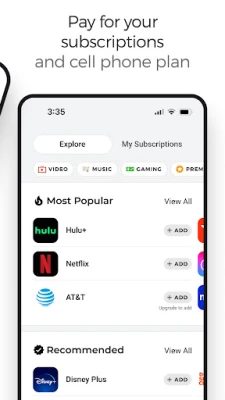

- Connect your subscriptions to be paid using your Grow Credit Debit Mastercard, including popular services like Netflix, Hulu, Spotify, and over 100 more.

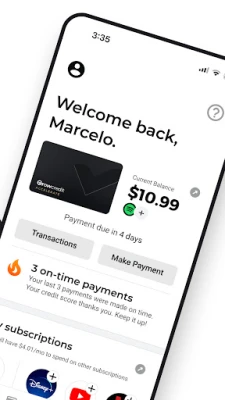

Your subscriptions will be charged to your Grow Credit Debit Mastercard, and we will automatically withdraw the monthly payments from your bank account. Additionally, we report your progress to all three credit bureaus, helping you build a stronger credit profile.

The Financial Benefits of a Better Credit Score

A higher credit score translates to lower interest rates on future loans, which can lead to significant savings over time. Whether you're looking to secure a mortgage, finance a vehicle, or obtain a credit card, a solid credit score opens doors to better financial opportunities.

No Impact on Your Credit Score

Applying for Grow Credit does not involve a hard credit inquiry, ensuring that your credit score remains unaffected during the application process.

What the Press Says About Grow

Grow has garnered positive attention from various media outlets:

- TechCrunch: "Grow is a pretty elegant way to solve a problem that's a real barrier to entry for a large number of financial services. Credit scores can impact mortgages, the ability to receive small business loans, and a host of other services that are ways to boost economic opportunity."

- CreditCards.com: "Grow is a very useful tool for climbing the ladder and eventually qualifying for a better card."

- NerdWallet: "The Grow Credit Mastercard is ideal for those with no credit or poor credit."

Membership Plans Tailored to Your Needs

Grow offers four distinct membership plans designed to cater to various credit-building needs:

1. Build Plan

- Reports a $204 credit line to Equifax, Experian, and TransUnion.

- $17 monthly spending limit.

- Option to upgrade to a Grow membership after six months of consecutive on-time payments.

- Cost: Free for the first 12 months, then $3.99/month.

2. Build Secured Plan

- Reports a $204 credit line to Equifax, Experian, and TransUnion.

- $17 monthly spending limit.

- Option to upgrade to a Grow membership after six months of consecutive on-time payments.

- $17 security deposit required, refundable after 12 consecutive on-time payments.

- Cost: $3.99 per month.

3. Grow Plan

- Reports a $600 credit line to Equifax, Experian, and TransUnion.

- $50 monthly spending limit.

- Access to premium subscriptions, including your cell phone bill (AT&T, T-Mobile, Verizon, or Sprint).

- Cost: $6.99 per month.

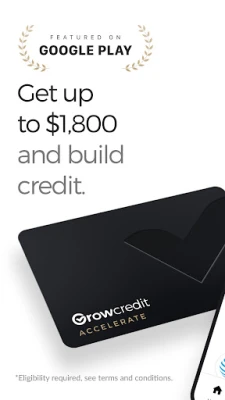

4. Accelerate Plan

- Reports an $1,800 credit line to Equifax, Experian, and TransUnion.

- $150 monthly spending limit.

- Access to premium subscriptions, including your cell phone bill (AT&T, T-Mobile, Verizon, or Sprint).

- Cost: $12.99 per month.

Additional Features of Grow Membership

- Plan duration: 12 months, renewable.

- Monthly FICO Score updates.

- Access to credit education blogs and tutorials.

Grow is committed to supporting you on your credit-building journey. With our user-friendly platform and dedicated resources, you can take control of your financial future.

Your Security is Our Priority

Your data is safeguarded with 256-bit encryption, ensuring bank-level security. We never store your information on your devices, providing you with peace of mind as you work towards improving your credit score.

This application is operated by Grow Credit, Inc. For any questions or suggestions, feel free to reach out to us at behappy@growcredit.com.

Start your journey to a better credit score today with Grow Credit!

Rate the App

User Reviews

Popular Apps

Editor's Choice