Latest Version

December 04, 2025

GoldEra

Finance

Android

0

Free

com.tradepss.golderaprotradingandroid

Report a Problem

More About Gold Era Pro Trading

Unlocking the Power of Physical Commodity Trading and Margin Trading Strategies

In the ever-evolving landscape of financial markets, understanding various trading methods is crucial for investors seeking to maximize their returns. Two prominent strategies that stand out are physical commodity trading and margin trading. Each offers unique advantages and challenges, catering to different types of investors and businesses. This article delves into these trading methods, highlighting their benefits and risks.

Understanding Physical Commodity Trading

Physical commodity trading involves the buying and selling of tangible assets, allowing clients to receive actual physical goods upon request. This method ensures that investors can settle trades by taking possession of underlying assets, such as precious metals, agricultural products, or energy resources, once the transaction is finalized.

Benefits of Physical Commodity Trading

For investors seeking tangible ownership, physical commodity trading presents several advantages:

- Tangible Assets: Investors gain direct ownership of physical goods, which can serve as a hedge against inflation and economic uncertainty.

- Operational Needs: Businesses that require physical delivery of goods for their operations can benefit significantly from this trading method, ensuring a steady supply of necessary resources.

- Market Diversification: Investing in physical commodities allows for diversification within a portfolio, reducing overall risk by spreading investments across different asset classes.

Who Should Consider Physical Commodity Trading?

This trading method is particularly appealing to:

- Investors looking for a hedge against market volatility.

- Businesses that rely on physical goods for production or service delivery.

- Individuals interested in investing in precious metals as a store of value.

Exploring Margin Trading

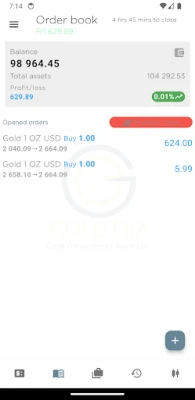

Margin trading introduces a dynamic and flexible approach to trading, allowing clients to engage in transactions by investing only a fraction of the total asset value. This strategy enhances trading opportunities, enabling investors to gain greater market exposure with a lower capital outlay.

The Mechanics of Margin Trading

In margin trading, investors borrow funds from a broker to trade larger positions than their initial capital would allow. This leverage can amplify potential returns, making it an attractive option in fast-moving markets such as forex, equities, and commodities.

Advantages of Margin Trading

Margin trading offers several key benefits:

- Increased Leverage: Investors can control larger positions, potentially leading to higher profits from favorable market movements.

- Enhanced Flexibility: Margin trading allows for quick entry and exit from positions, making it easier to capitalize on short-term market fluctuations.

- Access to Diverse Markets: Traders can explore various asset classes, including stocks, currencies, and commodities, all while using margin to enhance their trading strategies.

Risks Associated with Margin Trading

While margin trading can be lucrative, it also carries significant risks:

- Potential for Greater Losses: If the market moves against an investor's position, losses can exceed the initial margin, leading to substantial financial repercussions.

- Margin Calls: Brokers may require additional funds if the value of the investor's account falls below a certain threshold, forcing them to deposit more capital or liquidate positions.

- Market Volatility: Rapid price fluctuations can lead to unexpected losses, making it essential for traders to have a solid risk management strategy in place.

Who Should Engage in Margin Trading?

Margin trading is best suited for:

- Experienced traders who understand market dynamics and risk management.

- Investors looking to maximize their returns through leveraged positions.

- Individuals willing to actively monitor their investments and respond quickly to market changes.

Conclusion: Choosing the Right Trading Method

Both physical commodity trading and margin trading offer unique opportunities for investors and businesses. Physical commodity trading provides tangible ownership and security, making it ideal for those seeking to hedge against economic uncertainty. On the other hand, margin trading offers the potential for amplified returns through leverage, appealing to those willing to navigate its inherent risks.

Ultimately, the choice between these trading methods depends on individual investment goals, risk tolerance, and market knowledge. By understanding the nuances of each strategy, investors can make informed decisions that align with their financial objectives.

Rate the App

User Reviews

Popular Apps

Editor's Choice