Latest Version

8.65.0

November 08, 2024

gohenry Ltd

Finance

Android

0

Free

com.pktmny.mobile

Report a Problem

More About GoHenry: Banking for Under-18s

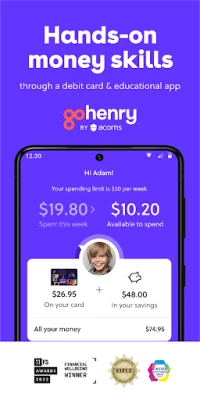

Unlocking Financial Literacy: The Benefits of GoHenry by Acorns for Kids, Parents, and Teens

In today's fast-paced world, teaching children about money management is more crucial than ever. GoHenry by Acorns offers a comprehensive solution that empowers kids, parents, and teens to navigate their financial journeys with confidence. This article explores the myriad benefits of GoHenry, highlighting how it fosters financial literacy and responsibility from a young age.

Empowering Kids with GoHenry

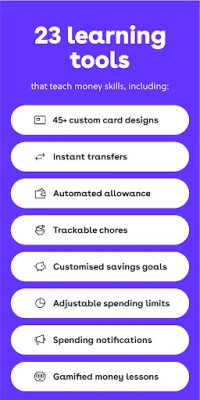

GoHenry provides a unique platform designed specifically for children, enabling them to learn essential money management skills through practical experience. Here are some of the standout features that make GoHenry an invaluable tool for young learners:

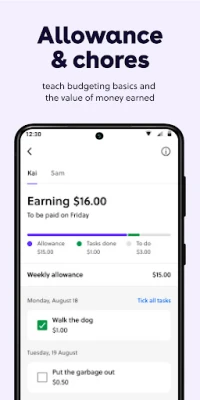

Automated Allowance: A Lesson in Budgeting

With GoHenry, parents can set up an automated weekly allowance for their children. This feature not only teaches kids the importance of budgeting but also instills the understanding that once their money is spent, it’s gone. This real-world lesson in financial responsibility is invaluable as they grow.

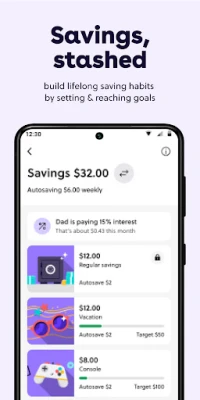

Child-Led Savings Goals: Cultivating a Savings Habit

GoHenry encourages children to set their own savings goals, making the process of saving engaging and personal. Parents can lock and unlock these goals, providing guidance while allowing kids to take the lead in their financial decisions.

In-App Task Lists: Earning Through Chores

Teaching kids the value of hard work is essential. GoHenry allows parents to create task lists for chores, rewarding children with money for completed tasks. This feature reinforces the concept of earning money through effort, making financial literacy a fun and interactive experience.

Bite-Sized Lessons: Boosting Financial Literacy

GoHenry’s in-app Money Missions provide bite-sized lessons that enhance children's understanding of money management. On average, kids who complete these missions transfer over 30% more into their savings within the first month, showcasing the effectiveness of this educational approach.

Personalized Prepaid Card: Real-World Practice

Each child receives their own prepaid debit card, allowing them to practice their newfound skills in real-world scenarios. With over 45 designs to choose from, kids can express their individuality while learning to manage their finances responsibly.

Fee-Free Travel: Enjoying Family Holidays

Traveling abroad with family is made easier with GoHenry, as it offers fee-free transactions overseas. This feature allows families to enjoy their vacations without worrying about additional charges, making it a practical choice for parents and kids alike.

Money Management Skills: Tracking Cash Flow

GoHenry empowers children to track their cash flow directly within the app. This hands-on approach helps them understand their spending habits and encourages responsible financial behavior.

ATM Withdrawals: Accessing Cash When Needed

For situations that require cash, GoHenry allows children to withdraw money from ATMs, providing them with the flexibility to manage their finances effectively.

Benefits for Parents: Simplifying Financial Management

GoHenry not only benefits children but also provides parents with tools to manage their kids' finances seamlessly. Here are some key advantages for parents:

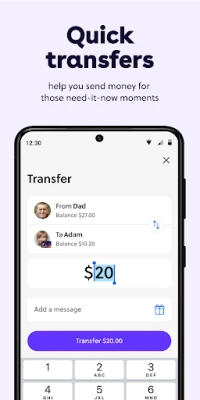

Quick and Easy Transfers: Instant Allowance Management

Parents can send money to their children anytime, thanks to scheduled allowances and instant transfers. This feature simplifies the process of managing finances and ensures that kids receive their money promptly.

Incentivizing Chores: Encouraging Responsibility

By setting up task lists and rewarding completed chores, parents can incentivize responsibility and hard work. This approach not only teaches kids about earning but also fosters a sense of accomplishment.

Spending Visibility: Real-Time Tracking

GoHenry provides parents with real-time notifications, allowing them to track their child's spending. This transparency helps parents guide their children in making informed financial decisions.

Flexible Controls: Customizing Spending Limits

Parents have the ability to set limits on when, where, and how much their child can spend. This flexibility ensures that parents can adapt their preferences as their child grows and learns.

A Family Affair: Involving Loved Ones

GoHenry makes it easy for family and friends to contribute to a child's financial education. With Giftlinks and Relatives accounts, loved ones can send money directly to the child's card, fostering a supportive financial environment.

Insights for Parents: Supporting Financial Education

The Parent Space within the GoHenry app offers valuable insights and tips to help parents support their child's financial education. This resource ensures that parents are equipped to guide their children effectively.

Giving Made Easy: Teaching Philanthropy

GoHenry encourages children to understand the importance of helping others through optional charitable donations in-app. This feature instills a sense of social responsibility and empathy from a young age.

Teen Banking Benefits: Growing Independence

As children transition into their teenage years, GoHenry adapts to their evolving needs. Here are some benefits specifically designed for teens:

The Account That Grows with You: Teen Debit Card

Teens can enjoy a debit card tailored to their needs, complete with features designed specifically for them. This account promotes independence while ensuring they have the tools to manage their finances effectively.

Split the Bill: Easy Money Transfers

Teens can request or send money to friends effortlessly using GoHenry. This feature simplifies group outings and encourages responsible spending among peers.

Request Money, Get Paid: QR Code Convenience

Teens can easily get paid in person using QR codes, even if the payer doesn’t use GoHenry. This feature streamlines transactions and enhances financial interactions.

Control Your Savings: Goal Setting

Teens can set savings goals within the app, allowing them to save for must-have purchases. This feature encourages financial planning and prioritization.

Ready for Your Side Hustle: Direct Deposits

Teens aged 14 and older can receive wages directly into their GoHenry account, making it easier to manage earnings from part-time jobs or side hustles.

Your Money Sidekick: Google Pay Integration

Teens can link their GoHenry

Rate the App

User Reviews

Popular Apps

Editor's Choice