Latest Version

2.0.15

February 06, 2025

Game - Financial Literacy

Games

iOS

92.8 MB

0

Free

Report a Problem

More About Give-Get Financial Board Game

Mastering Financial Literacy: A Student's Guide to Budgeting and Investing

Understanding personal finance is crucial for students navigating their financial journey. This article explores essential expenses, emergency funds, and the importance of budgeting, saving, and investing. By mastering these concepts, students can make informed decisions that lead to financial stability and growth.

Understanding Essential Expenses and Emergency Funds

To effectively manage finances, students must first identify their essential expenses. These include necessities such as housing, food, transportation, and education costs. Once these expenses are accounted for, establishing an emergency fund becomes vital. An emergency fund acts as a financial safety net, covering unexpected costs like medical emergencies or car repairs. With essential expenses and an emergency fund secured, students can allocate any remaining funds towards discretionary spending, saving, or investing.

Discretionary Spending: Making Smart Choices

When it comes to discretionary spending, students have two primary options. They can either choose to save their money or invest it wisely. Keeping money idle, akin to hiding it under a mattress, does not yield any returns. Conversely, investing can potentially generate income, depending on the chosen investment vehicle. Understanding the difference between saving and investing is crucial for building wealth over time.

The Importance of Budgeting: The Four Corners of Financial Management

The Four Corners of the financial board represent the foundational aspects of budgeting. Establishing a budget—whether weekly, monthly, or annually—is the first step toward financial control. Students must assess their income and expenses to determine how much money remains for saving and investing. A well-structured budget helps students track their spending habits and make necessary adjustments to achieve their financial goals.

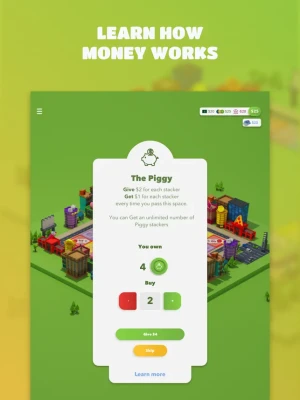

Guaranteed Savings: The Role of the Piggy Bank

The Piggy Bank symbolizes guaranteed savings accounts, which are essential for a robust retirement planning strategy. Various guaranteed savings vehicles, such as pensions and annuities, provide a reliable source of income. Additionally, traditional checking and savings accounts, certificates of deposit (CDs), and money market funds are considered safe investments that offer varying interest rates. These options serve as the foundation for building a secure financial future.

Investing for the Future: The Chart of Opportunities

The Chart represents non-guaranteed investment accounts, which are crucial for long-term financial growth. For students saving for goals that are ten years or more away, investing in the stock market can be a lucrative option. Various investment vehicles, including individual stocks, passive index funds, and actively managed mutual funds, allow students to grow their wealth over time. Understanding market trends and investment strategies is essential for making informed decisions in this arena.

Speculation and Risk: The Ticket to Uncertainty

The Ticket symbolizes speculation and gambling, which can lead to significant financial losses. Activities such as playing the lottery, betting on sports, or gambling in casinos are high-risk endeavors. Unlike investing, where informed decisions can lead to growth, gambling is an all-or-nothing proposition. Students should approach these activities with caution, understanding that the odds are often not in their favor.

Asset Ownership: The House of Wealth

The House represents asset ownership, illustrating how assets can appreciate over time. However, it’s important to note that assets can also lose value if sold under unfavorable conditions. Owning assets such as a primary residence, investment properties, or even collectibles can be financially rewarding. Students should consider the long-term benefits of asset ownership as part of their financial strategy.

Borrowing Wisely: The Pillars of Financial Support

The Pillars signify borrowing, which can be a beneficial financial tool when used responsibly. Students must have a clear repayment plan and a strategy for utilizing borrowed funds effectively. Common forms of borrowing include home loans, lines of credit, credit cards, and student loans. Understanding the terms and implications of borrowing is essential for maintaining financial health.

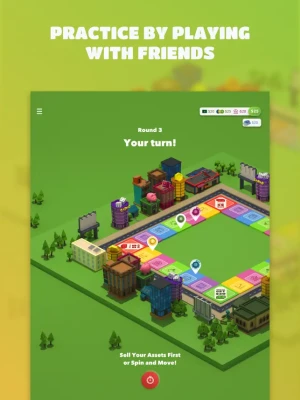

Winning the Financial Game: Achieving Success

In the financial game, students can achieve success by either outsmarting their opponents or reaching a net worth of at least $100. Financial literacy equips students with the knowledge and skills necessary to navigate their financial landscape effectively. By making informed decisions, they can secure their financial future and achieve their goals.

Scholarship Opportunities: Leveraging Financial Competitions

Students can also explore scholarship opportunities through national competitions that utilize financial literacy apps. These platforms not only enhance financial knowledge but also provide avenues for financial support in their educational pursuits. Engaging in such competitions can be a valuable experience, fostering both learning and potential financial rewards.

In conclusion, mastering financial literacy is essential for students as they embark on their financial journeys. By understanding essential expenses, budgeting, saving, investing, and borrowing wisely, they can build a solid foundation for their future. With the right knowledge and strategies, students can navigate the complexities of personal finance and achieve their financial goals.

Rate the App

User Reviews

Popular Apps

Editor's Choice