Latest Version

5.0.31

April 19, 2025

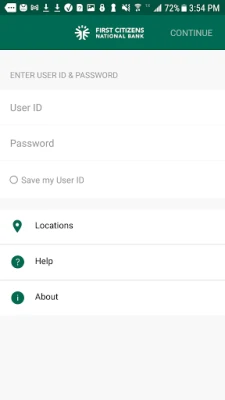

FCNB

Finance

Android

0

Free

com.mfoundry.mb.android.mb_12t

Report a Problem

More About FirstCNB

Unlock the Power of Mobile Banking: Features You Can't Miss

In today's fast-paced world, managing your finances on the go has never been easier. With advanced mobile banking features, you can take control of your accounts right from your smartphone. This article explores the essential functionalities that make mobile banking a must-have for anyone looking to streamline their financial management.

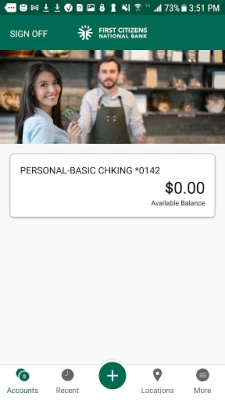

Manage Your Accounts with Ease

Stay updated on your financial status by checking your latest account balance anytime, anywhere. The mobile banking app allows you to:

- View your current account balance in real-time.

- Search recent transactions effortlessly by date, amount, or check number.

This feature ensures that you are always aware of your spending habits and can make informed financial decisions.

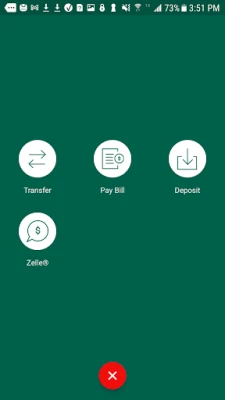

Seamless Transfers Between Accounts

Transferring funds between your accounts has never been simpler. With just a few taps, you can:

- Instantly transfer cash between your checking and savings accounts.

- Manage your funds efficiently without the need to visit a bank branch.

This functionality is perfect for those who want to maintain a healthy balance across their accounts without any hassle.

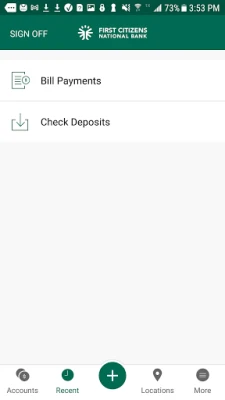

Effortless Bill Payments

Say goodbye to late fees and missed payments with the mobile Bill Pay feature. Once enrolled, you can:

- Make payments to existing payees directly from your mobile device.

- Cancel scheduled bills with ease.

- Review previously paid bills to keep track of your expenses.

This feature not only saves you time but also helps you stay organized and on top of your financial commitments.

Deposit Checks Anytime, Anywhere

With mobile check deposit, you can deposit checks while on the go. This feature allows you to:

- Snap a photo of your check and deposit it directly into your account.

- Avoid the inconvenience of visiting a bank branch or ATM.

Mobile deposits provide a quick and secure way to manage your funds, ensuring that your money is available when you need it.

Find Branches and ATMs Near You

Need to locate a bank branch or ATM? The mobile banking app utilizes your device's built-in GPS to help you:

- Find nearby branches and ATMs with ease.

- Search by zip code or address for more specific results.

This feature is invaluable for those who are traveling or simply need to access cash quickly.

Conclusion: Embrace the Future of Banking

Mobile banking offers a suite of features designed to enhance your financial management experience. From checking your account balance to making deposits and paying bills, these functionalities empower you to take control of your finances with convenience and security. Embrace the future of banking and make the most of these innovative tools at your fingertips.

Rate the App

User Reviews

Popular Apps

Editor's Choice