Latest Version

6.25.6

April 28, 2025

DolarApp

Finance

Android

1

Free

com.dolarapp

Report a Problem

More About DolarApp

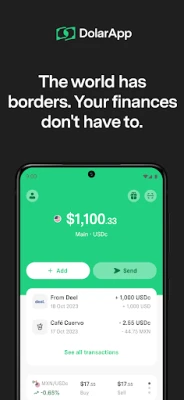

Unlock Financial Freedom with DolarApp: Your Gateway to Digital Dollars

In today's fast-paced world, managing your finances efficiently is crucial, especially in countries like Mexico, Argentina, Colombia, and Brazil. DolarApp offers a seamless solution for individuals looking to safeguard their assets against currency volatility and enjoy hassle-free transactions. This article explores the benefits of DolarApp, including opening an account, using the international travel card, and receiving payments from the United States—all without hidden fees.

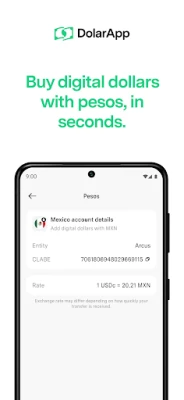

Open Your DolarApp Account in Seconds

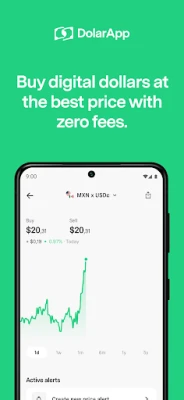

With DolarApp, you can open an account in mere seconds, ensuring you have immediate access to digital dollars at the interbank rate. This feature allows you to hold your funds securely and monitor current and historical prices in real-time through the app. By choosing DolarApp, you can protect yourself from peso devaluation and enjoy the freedom of sending and receiving digital dollars instantly and free of charge to any DolarApp user.

Instant Access to Digital Dollars

Each digital dollar in your DolarApp account is equivalent to one U.S. dollar at a U.S. bank. This unique feature provides peace of mind, knowing that your funds are stable and easily accessible. Whether you are looking to save, invest, or simply manage your day-to-day expenses, DolarApp offers a reliable platform to do so.

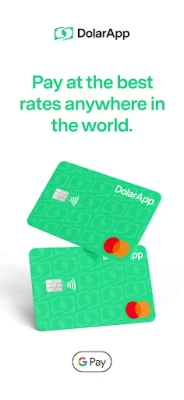

Experience the Best International Travel Card with Cashback

Traveling abroad? DolarApp's international DolarCard allows you to pay in various currencies, including pesos, dollars, and euros, at the best exchange rates without hidden fees. You can choose between a physical or virtual card, making it convenient for any traveler. Additionally, using your DolarCard helps you build a credit history, which can be beneficial for future financial endeavors.

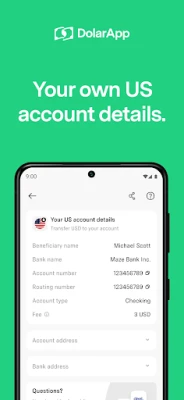

Receive Payments from the United States Effortlessly

DolarApp is ideal for expatriates, digital nomads, and remote workers. With a U.S. account number, you can receive payments and transfers as if you were living in the United States. This feature is perfect for collecting remittances at competitive exchange rates. You can easily receive payments from platforms like Deel, Upwork, and OnTop directly into your DolarApp account, streamlining your financial management.

No Hidden Fees, No Minimum Balance

One of the standout features of DolarApp is its transparency. There are no minimum balance fees, maintenance fees, or any hidden charges that traditional banks often impose. With DolarApp, what you see is what you get, allowing you to manage your finances without unexpected surprises.

Your Security is Our Top Priority

When it comes to online transactions, security is paramount. DolarApp employs 3DS security to protect your online payments. Additionally, all accounts are safeguarded with a passcode, TouchID, or FaceID, ensuring that your information remains secure. DolarApp prioritizes the safety of your funds, giving you peace of mind while you manage your finances.

How to Get Started with DolarApp

Getting started with DolarApp is a breeze. Simply download the app and sign up in minutes. The registration process is straightforward, allowing you to begin using DolarApp right away. You can send pesos to your DolarApp CLABE (Mexico) or CVU/Alias (Argentina) number, or add funds via PSE (Colombia) to receive digital dollars instantly. No more waiting in line or carrying cash—open your commission-free account in seconds and take control of your financial future.

Conclusion: Embrace Financial Empowerment with DolarApp

DolarApp is revolutionizing the way individuals manage their finances in Mexico, Argentina, Colombia, and Brazil. With its user-friendly interface, instant access to digital dollars, and commitment to security, DolarApp empowers users to navigate the complexities of currency management effortlessly. Whether you're traveling, receiving payments, or simply looking to protect your assets, DolarApp is your go-to solution for financial freedom. Open your account today and experience the difference!

Rate the App

User Reviews

Popular Apps

Editor's Choice