Latest Version

December 02, 2025

Dreamplug Technologies Private Limited

Finance

Android

0

Free

com.dreamplug.androidapp

Report a Problem

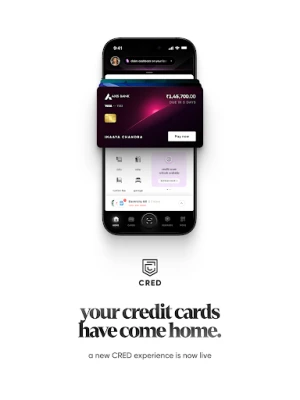

More About CRED: UPI, Credit Cards, Bills

Unlock Financial Freedom with CRED: Your Ultimate Payment and Credit Management Solution

Join over 14 million creditworthy members who trust CRED to reward them for their financial decisions and timely payments. With CRED, managing your finances has never been easier or more rewarding.

What Payments Can You Make on CRED?

CRED offers a comprehensive platform for managing various payments seamlessly. Here’s a breakdown of the payment options available:

- Credit Card Bills: Effortlessly check and manage all your credit cards in one place, eliminating the need for multiple apps.

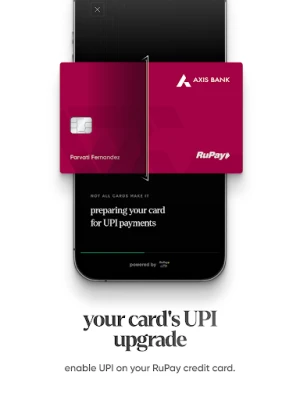

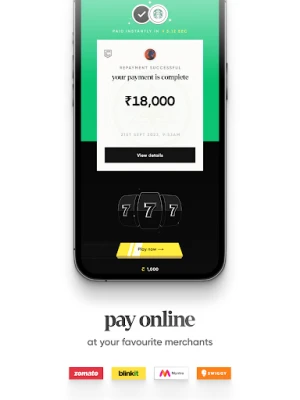

- Online Payments: Use CRED Pay to make payments on popular platforms like Swiggy and Myntra via UPI or credit card.

- Offline Payments: Enjoy contactless transactions by scanning QR codes or activating the Tap to Pay feature.

- Pay Anyone: Send money to anyone using CRED, regardless of whether they use BHIM UPI, PhonePe, GPay, or any other UPI app.

- Transfer Money to Bank Accounts: Easily send rent or education fees directly from your credit card.

- UPI Auto Pay: Set up automatic payments for recurring bills to ensure you never miss a due date.

- Pay Bills: Manage utility bills, credit card payments, DTH bills, mobile recharges, and more, with automatic reminders for due dates.

Benefits of CRED Membership

As a CRED member, you gain access to a suite of features designed to enhance your financial management:

- Effortlessly manage multiple credit cards.

- Track your credit score and bank balance in real-time.

- Identify hidden charges and duplicate expenses.

- Receive smart statements for better financial insights.

- Unlock exclusive rewards and privileges tailored for you.

Types of Bills You Can Pay Using CRED

CRED allows you to pay a variety of bills using your credit card or UPI:

- Rent: Cover house rent, maintenance fees, office rentals, security deposits, and brokerage.

- Education: Pay college fees, school fees, and tuition costs.

- Telecom Bills: Recharge your Airtel, Vodafone, Vi, Jio, Tata Sky, DishTV, and broadband connections.

- Utility Bills: Pay for electricity, LPG, water, municipal taxes, and piped gas online.

- Other Bills: Manage Fastag recharges, insurance premiums, and loan repayments.

How to Become a CRED Member

Joining CRED is simple and straightforward:

- Ensure your credit score is 750 or above.

- Download the CRED app.

- Fill in your name, mobile number, and email ID.

- Receive a free credit score report.

- If eligible, verify your credit card details to complete the registration.

Manage Your Credit Score with CRED

Your credit score is more than just a number; it reflects your financial health. With CRED, you can:

- Monitor your past and present credit scores.

- Identify factors affecting your CIBIL score.

- Make informed predictions to improve your credit score.

- Rest assured that all your credit information is encrypted and securely monitored.

Supported Credit Cards on CRED

CRED supports a wide range of credit cards, including:

- HDFC Bank

- SBI

- Axis Bank

- ICICI Bank

- RBL Bank

- Kotak Mahindra Bank

- IndusInd Bank

- IDFC First Bank

- YES Bank

- Bank of Baroda

- AU Small Finance Bank

- Federal Bank

- Citi Bank

- Standard Chartered Bank

- SBM Bank India Limited

- DBS Bank

- South Indian Bank

- AMEX

- HSBC Bank

- All VISA, Mastercard, Rupay, Diners Club, AMEX, and Discover credit cards.

Personal Loans and Eligibility Criteria

CRED also offers personal loans with the following eligibility criteria:

- Age: 21-60 years

- Annual Household Income: ₹3,00,000

- Residency: Must be a resident of India

- Loan Amount: ₹100 to ₹20,00,000

- Repayment Tenure: 1 Month to 84 Months

Loan Against Mutual Fund Eligibility Criteria

If you’re considering a loan against mutual funds, here are the eligibility requirements:

- Age: 18-65 years

- Mutual Fund Investment: Minimum ₹2000 portfolio

- Residency: Must be a resident of India

- Loan Amount: ₹1000 to ₹50,00,000

- Repayment Tenure: 1 Month to 60 Months

Understanding the Annual Percentage Rate (APR)

The APR for loans through CRED ranges from 9.5% to 45%. For example, if you borrow ₹5,00,000 for three years at an interest rate of 20% per annum, your monthly EMI would be

Rate the App

User Reviews

Popular Apps

Editor's Choice