Latest Version

7.1.0

February 16, 2026

Thrivos, Inc.

Finance

Android

0

Free

com.thrivos.cash1

Report a Problem

More About CASH 1

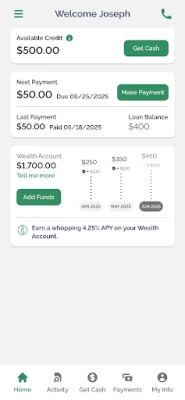

Unlock Financial Flexibility with the CASH 1 Mobile App

The CASH 1 Mobile App serves as a convenient platform for managing your financial needs, specifically designed for customers in select states. Currently, residents of Arizona, Idaho, Kansas, Louisiana, Missouri, Nevada, and Utah can utilize this app to sign up for an account and access their existing services. However, it’s important to note that new customers cannot obtain loan products directly through the app at this time.

Service Availability by State

CASH 1 operates exclusively in states where it holds the necessary licenses, ensuring compliance with both state and federal regulations. For detailed licensing information, you can visit NMLS Consumer Access and CASH 1 Loans.

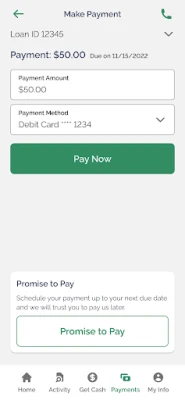

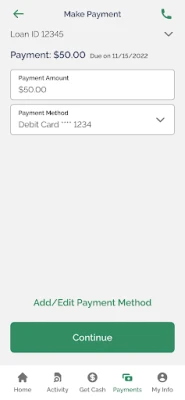

Loan Products and Repayment Terms

All loan products offered through the CASH 1 Mobile App come with a repayment period of three months or longer, with a maximum term of 24 months. This flexibility allows customers to choose a repayment plan that best fits their financial situation.

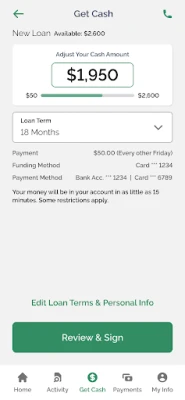

Introducing the Wealth Loan Line of Credit

For customers in Louisiana, the CASH 1 Mobile App provides access to the Wealth Loan line of credit. This unique financial product not only offers a line of credit but also includes a savings account that earns interest up to 4% APY. This means you can build your wealth while managing your credit obligations.

Understanding the Costs of the Wealth Loan

Here’s a representative example of the total cost associated with the Wealth Loan line of credit:

- Initial Cash Advance: $1,000.00

- Term: 17 months*

- APR: 27%

- Setup Fee: $50.00

- Monthly Statement Fee: $10.00

- Monthly Payment: $86.00

- Total Interest: $214.94

- Total Cost (Interest + Fees): $424.94

- Total Repayment Amount: $1,424.94

*Note: The line of credit is open-ended, but the above term reflects the effective repayment period assuming no further advances and timely payments.

Your Privacy Matters

CASH 1 values your privacy and does not sell your personal information. For more details, please review our Privacy Notice and Privacy Policy.

Conclusion

The CASH 1 Mobile App is a powerful tool for existing customers in select states, offering a range of financial services tailored to meet your needs. Whether you’re looking to manage your account or explore the Wealth Loan line of credit, CASH 1 provides a secure and compliant platform to help you achieve your financial goals. Download the app today and take the first step towards financial flexibility!

Rate the App

User Reviews

Popular Apps

Editor's Choice