Latest Version

3.1.0.5

March 31, 2025

C24 Bank GmbH

Finance

Android

0

Free

de.c24.bankapp

Report a Problem

More About C24 Bank

Unlock the Future of Banking with C24: Your Ultimate Guide to a Modern Giro Account

In today's fast-paced world, managing your finances should be as convenient as possible. With the C24 app, you can handle all your banking needs anytime, anywhere. Discover the numerous advantages of the C24 Giro account that make it stand out in the competitive banking landscape.

Germany's Premier Giro Account

Experience attractive interest rates on both your Giro account and savings. C24 offers a unique opportunity to grow your money while enjoying the flexibility of modern banking. With competitive rates, your savings can work harder for you, ensuring you achieve your financial goals.

Free C24 Mastercard and Girocard

With the C24 Mastercard and Girocard, you can make payments effortlessly. Enjoy the convenience of up to eight free virtual C24 Mastercards, allowing you to shop online or in-store without any hassle. This feature ensures that you can manage your spending while enjoying the benefits of cashless transactions.

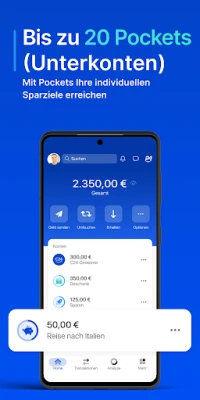

Achieve Your Savings Goals with Pockets

Set up sub-accounts with their own IBANs to help you reach your individual savings targets. The Pockets feature allows you to transfer money from your main account to your designated savings accounts easily. Whether you're saving for a vacation, a new gadget, or an emergency fund, Pockets makes it simple to stay organized and focused on your financial objectives.

Share Accounts with Friends and Family

Collaboration is key when it comes to managing finances. C24 allows you to share your accounts with friends and family, making it easier to manage joint expenses or save together for a common goal. This feature fosters transparency and accountability, ensuring everyone is on the same page regarding financial matters.

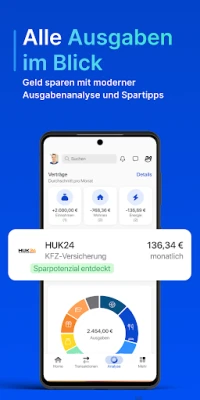

Keep Track of Your Expenses

With advanced expense analysis and contract recognition, C24 helps you make the most of your money. The app categorizes your spending, providing insights and tips on how to optimize your regular expenses and contracts. This feature empowers you to take control of your finances and make informed decisions about your spending habits.

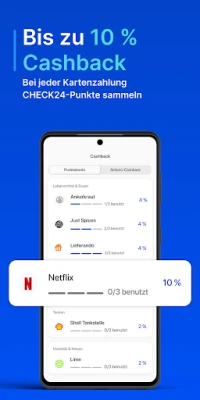

Up to 10% Cashback on Card Transactions

Every time you make a purchase with your C24 card, you can earn up to 10% cashback on the transaction value. This rewarding feature not only enhances your shopping experience but also allows you to save money while spending. It's a win-win situation that adds value to your everyday purchases.

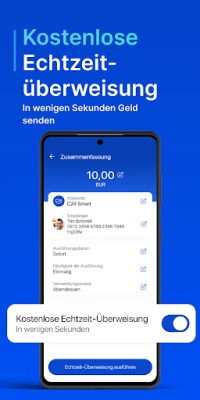

All Your Finances in One App with Multi-Banking

No matter how many accounts you have, the C24 Bank app allows you to integrate accounts from other banks seamlessly. This multi-banking feature ensures that you have a comprehensive view of your finances, making it easier to manage your money effectively and stay on top of your financial commitments.

Secure Banking Experience

Your security is a top priority at C24 Bank. With a German banking license, your savings are protected by statutory deposit insurance up to €100,000. This assurance provides peace of mind, knowing that your hard-earned money is safe and secure.

C24 Bank: A Member of the CHECK24 Group

As part of the CHECK24 Group, C24 Bank offers a wide range of services through over 300 partner banks. Whether you're looking for a loan or an investment opportunity, you can find the best market offers through CHECK24 comparisons. This commitment to fairness and transparency ensures that you receive the best financial solutions tailored to your needs.

Conclusion

The C24 Giro account is designed for the modern individual who values convenience, security, and financial growth. With its innovative features, competitive rates, and user-friendly app, C24 is redefining the banking experience in Germany. Embrace the future of banking and take control of your finances with C24 today!

Rate the App

User Reviews

Popular Apps

Editor's Choice