Latest Version

February 24, 2025

Interactive Communications International, Inc.

Finance

Android

0

Free

com.bluebird.mobile

Report a Problem

More About Bluebird

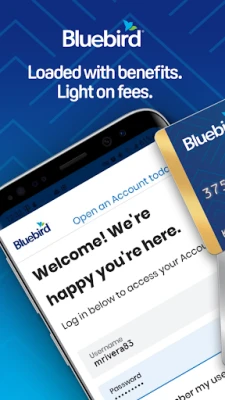

Unlock Financial Freedom with Bluebird: Your Ultimate Money Management Solution

In today's fast-paced world, managing your finances efficiently is crucial. Bluebird offers a revolutionary financial account designed to provide you with the flexibility and convenience you need to take control of your money. With no monthly fees and a plethora of fee-free features, Bluebird simplifies your daily financial tasks, allowing you to focus on what truly matters in your life.

Discover the Bluebird App: Your Financial Companion

The Bluebird app empowers you to manage your finances effortlessly, no matter where you are. With a user-friendly interface, you can:

- Log in to access your Available Balance instantly.

- View detailed information about all your active and completed transactions.

Effortless Money Management: Adding Funds

Adding money to your Bluebird account is a breeze. Here are some convenient options:

- Add cash fee-free at Family Dollar locations.

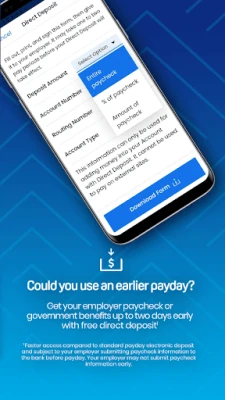

- Receive your paycheck up to two days faster with free early direct deposit.

- Utilize your mobile device to easily add money from checks.

Accessing Your Funds: Money Out Made Simple

With Bluebird, accessing your funds is straightforward:

- Make purchases online or in-store using your Bluebird card.

- Withdraw cash for free at over 37,000 MoneyPass ATMs nationwide.

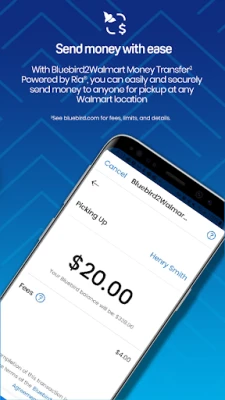

- Send money effortlessly to other Bluebird accountholders.

Trusted Partnerships for Your Peace of Mind

Bluebird collaborates with reputable partners such as American Express, Family Dollar, and Visa to ensure you receive the reliability and value you deserve. Our commitment to your security is unwavering:

- We prioritize the safety of your information and funds.

- Our dedicated 24/7 Customer Service representatives are available to assist you at any time.

Important Information to Consider

While Bluebird offers numerous benefits, it's essential to be aware of certain details:

- You can add cash at various locations for a fee of up to $3.95. As of July 1, 2023, cash reloads at Walmart will incur a fee of $3.74 per transaction. For more information, visit bluebird.com/faqs.

- Early direct deposit allows faster access to your funds compared to standard payday electronic deposits, contingent on your employer submitting paycheck information before payday.

- The Mobile Check Capture service, provided by First Century Bank, N.A. and Ingo Money, Inc., is subject to approval. Fees may apply for expedited funding. For details, visit bluebird.com/fees.

- Transactions at non-MoneyPass ATMs incur a $2.50 fee, and additional ATM operator fees may apply. For more information, visit bluebird.com/atm.

Conclusion: Take Control of Your Finances with Bluebird

Bluebird is more than just a financial account; it’s a comprehensive solution designed to help you manage your money with ease. With its user-friendly app, fee-free features, and trusted partnerships, Bluebird empowers you to take control of your financial future. Visit Bluebird.com today to learn more and start your journey towards financial freedom.

Rate the App

User Reviews

Popular Apps

Editor's Choice