Latest Version

2.82.0

February 11, 2025

ATM.com, Inc.

Finance

Android

0

Free

com.atm.atm.prod

Report a Problem

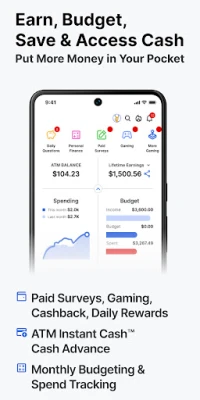

More About ATM Instant Cash™ & Rewards

Unlock Your Financial Potential with ATM Personal Finance

In today's fast-paced world, managing your finances effectively is more crucial than ever. With ATM Personal Finance, you gain control over your money while enjoying a suite of features designed to enhance your financial well-being. This comprehensive platform not only offers rewards but also equips you with essential tools for budgeting and spending tracking. Let’s explore how ATM Personal Finance can transform your financial landscape.

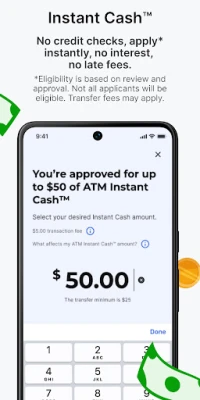

ATM Instant Cash™: Your Financial Safety Net

Unexpected expenses can arise at any moment, and having a reliable financial lifeline is essential. ATM Instant Cash™ provides quick access to cash without the hassle of credit checks, interest rates, or late fees. With cash advance limits ranging from $25 to $200*, you can efficiently manage emergency expenses and avoid costly overdraft fees. This feature is designed to give you peace of mind, allowing you to focus on what truly matters.

*Eligibility is based on review and approval. Not all applicants will qualify for ATM Instant Cash™. Transfer fees may apply.

Smart Spending Tracking and Budgeting Tools

Understanding your spending habits is vital for financial success. ATM Personal Finance offers robust tools that allow you to track your expenses month over month. Visualize your spending by category or merchant to gain valuable insights into your cash flow. With customizable budgets, you can set limits overall or per category, ensuring you stay on track with your financial goals.

Additionally, keep an eye on upcoming bills and easily identify unwanted or duplicate subscriptions. This proactive approach to budgeting helps you tighten your finances and make informed decisions about your spending.

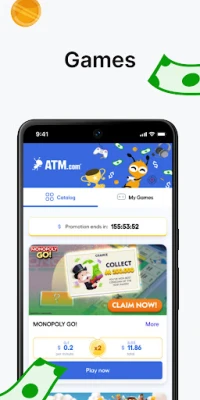

Earn While You Play: Gaming Rewards

If you enjoy gaming, ATM Personal Finance has an exciting opportunity for you. Users can earn up to $250 a month by playing games available on the platform. Earnings can range from $3 to $250, depending on your level of engagement. This innovative feature not only entertains but also serves as a lucrative side hustle for gamers looking to boost their income.

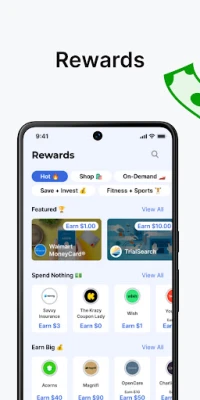

Maximize Your Earnings with the Rewards Portal

ATM Personal Finance offers a Rewards Portal with over 500 offers, allowing users to earn between $1 and $500. This user-friendly portal is an excellent way to grow your money effortlessly. By taking advantage of these offers, you can enhance your financial portfolio while enjoying various rewards.

Daily Rewards: Earn Cash Effortlessly

With ATM Personal Finance, earning rewards is as simple as answering a few questions daily. Nearly a million users have participated, earning cash in less than a minute. This feature is entirely free and provides a fantastic opportunity to earn daily without any investment of time or money. Make it a habit to check in and watch your earnings grow!

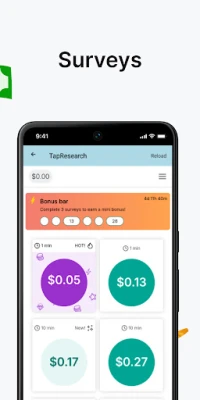

Paid Surveys: A Simple Way to Boost Your Income

ATM Personal Finance regularly adds new surveys, allowing users to earn between $0.03 and $5.00 for each completed survey. Most surveys take only a few minutes, making them an ideal side hustle for those looking to supplement their income. Unlike traditional rewards programs that offer gift cards or points, ATM Personal Finance provides cash directly, making it a more appealing option for users.

Location Rewards: Passive Income at Your Fingertips

Another unique feature of ATM Personal Finance is the Location Rewards program. Users can earn cash passively by sharing their locations and visiting stores. This feature allows you to earn rewards without actively participating in surveys or games. Simply enable Location Rewards when you install the ATM app, and start earning effortlessly as you go about your daily routine.

Conclusion: Take Control of Your Financial Future

ATM Personal Finance is more than just a rewards program; it’s a comprehensive financial management tool that empowers you to take control of your money. With features like ATM Instant Cash™, smart spending tracking, and various earning opportunities, you can enhance your financial health and achieve your goals. Whether you’re looking to manage unexpected expenses, earn extra cash, or simply keep track of your spending, ATM Personal Finance has you covered.

Start your journey towards financial empowerment today with ATM Personal Finance and unlock the potential of your money!

For more information, visit:

Rate the App

User Reviews

Popular Apps

Editor's Choice