Latest Version

1.3.7

April 06, 2025

AMC Theatres

Finance

Android

0

Free

com.amctheatres.creditcard

Report a Problem

More About AMC Entertainment Visa Card

Visualize Your Spending Habits: A Comprehensive Guide to Managing Your Finances

Understanding your spending habits is crucial for effective financial management. With innovative tools and features, you can now visualize where your money goes, making it easier to track and optimize your expenses. This article explores how to leverage these tools to gain insights into your financial behavior and maximize your rewards.

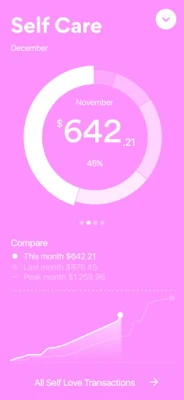

Interactive Spending Visualization

Imagine a homepage adorned with fun, floating bubbles that represent your spending categories. Each bubble serves as a gateway to deeper insights. By tapping on a bubble, you can expand the category to see how much you spent this month compared to last month, along with identifying your top expenditures within that category. This engaging visualization transforms the often tedious task of budgeting into an interactive experience, allowing you to grasp your financial habits at a glance.

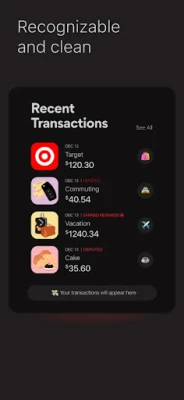

Streamlined Transaction Overview

Gone are the days of sifting through dull spreadsheets. Your transaction history is now presented in a clean, recognizable format. Large icons featuring merchant logos enable you to quickly identify where your money has gone. Transactions are organized by days, weeks, and months, providing a clear timeline of your spending. This organized layout not only enhances readability but also helps you spot trends and make informed decisions about your finances.

Maximize Your Rewards with Every Purchase

One of the most exciting aspects of managing your spending is the opportunity to earn rewards. With a robust rewards program, you can earn:

- 50 points for every $1 spent at AMC Theatres.

- 100 points per $1 as an A-List or Premiere member, and 20 points per $1 as an Insider.

- 20 points per $1 on everyday purchases such as dining, groceries, and gas.

- 10 points per $1 on all other purchases.

There are no hidden fees or complicated terms—just straightforward points that accumulate quickly, allowing you to redeem them for movie tickets, snacks, and more. This seamless rewards system encourages you to spend wisely while enjoying the benefits of your purchases.

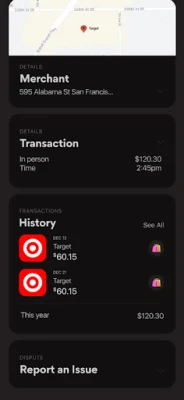

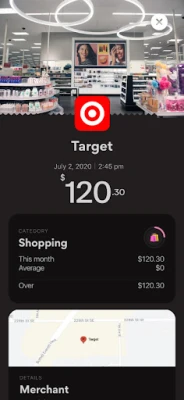

In-Depth Transaction Insights

Gain a comprehensive understanding of your spending with detailed transaction insights. Each purchase includes a picture, map, and logo of the merchant, providing context to your spending habits. You can also see how each transaction impacts your overall category spending for the month, along with a history of your expenditures with that merchant. If you’ve added a tip, a red heart icon will appear next to the transaction, making it easy to track your generosity. This level of detail empowers you to analyze your spending patterns and make adjustments as needed.

Effortless Scheduled Payments

Managing bills can be stressful, but setting up autopay can alleviate that burden. With this feature, you can ensure timely payments and avoid late fees or additional interest charges. Simply adjust the payment dial to see how much you need to pay for minimum, statement, and full balance payments. You’ll also receive notifications before payments are due, keeping you informed and in control of your financial obligations.

Conclusion: Take Control of Your Financial Future

Visualizing your spending habits is more than just a trend; it’s a powerful tool for financial empowerment. By utilizing interactive features, streamlined transaction overviews, and robust rewards programs, you can take charge of your finances like never before. Start today by exploring these tools and watch as your financial literacy and rewards grow, paving the way for a more secure financial future.

Note: Rewards are earned as AMC Stubs Points. Purchases do not include items returned for credit, or interest and account fees.

Rate the App

User Reviews

Popular Apps

Editor's Choice