Latest Version

25.1.1

February 13, 2025

Ally Financial

Finance

Android

0

Free

com.ally.MobileBanking

Report a Problem

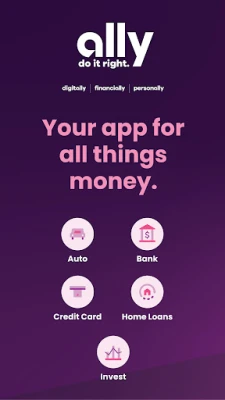

More About Ally: Bank, Auto & Invest

Unlocking the Benefits of Ally Financial Services: A Comprehensive Guide

In today's fast-paced financial landscape, managing your money efficiently is crucial. Ally Financial offers a suite of services designed to simplify your financial life, from auto loans to investment opportunities. This article delves into the various offerings from Ally, highlighting their features and benefits to help you make informed decisions.

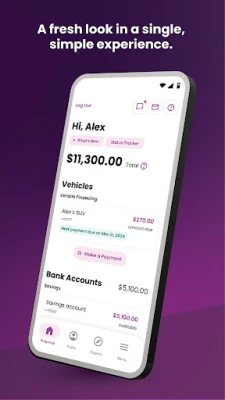

Ally Auto: Streamlined Vehicle Management

Ally Auto provides a user-friendly platform for managing your vehicle payments. Here are some key features:

- Flexible Payment Options: Make one-time vehicle payments or set up Auto Pay to schedule future payments effortlessly.

- Multi-Vehicle Management: Keep track of multiple vehicles from your Snapshot, making it easier to manage your finances.

- Financial Health Monitoring: Stay informed about your financial status with free FICO® Score updates, allowing you to make better financial decisions.

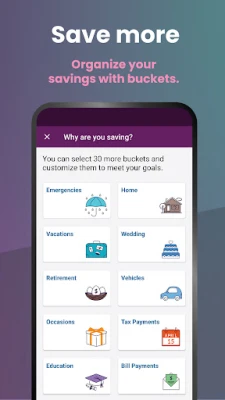

Ally Bank: Smart Savings Solutions

Ally Bank is committed to helping you save more effectively. Here’s how:

- Innovative Savings Tools: Utilize features like buckets and boosters to maximize your savings potential.

- No Hidden Fees: Enjoy the peace of mind that comes with avoiding monthly maintenance fees and hidden charges.

- FDIC Insurance: Your deposits are insured by the FDIC up to the maximum allowed by law, ensuring your money is safe.

Ally Credit Card: Secure and Convenient

The Ally Credit Card offers a secure way to manage your finances:

- Secure Payments: Make secure credit card payments and review your credit statements with ease.

- Free FICO® Score Access: Check your FICO® Score for free, helping you stay on top of your credit health.

- Exclusive Access: Ally Mastercard credit cards are available by invitation only, providing a sense of exclusivity.

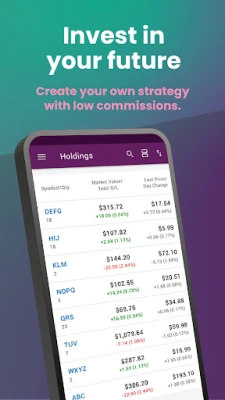

Ally Invest: Tailored Investment Strategies

For those looking to grow their wealth, Ally Invest offers various investment options:

- Robo Portfolio: Choose a strategy that suits your needs, with options for cash enhancement at no advisory fee or a fee-based, market-focused portfolio.

- Self-Directed Trading: For hands-on investors, trade commission-free on eligible U.S. stocks and funds, giving you control over your investments.

- Personalized Advice: Start with a $100,000 minimum in assets under care and receive ongoing guidance from a dedicated advisor for all your assets, even those not managed by Ally.

Ally Home: Simplifying Home Loan Management

Managing your home loan is easier with Ally Home:

- Real-Time Progress Tracking: Monitor your progress toward paying off your home loan with real-time updates.

- Autopay Convenience: Set up recurring payments through autopay with no additional fees, ensuring you never miss a payment.

Commitment to Security

Ally takes your security seriously:

- No Personal Data Storage: Ally never stores personal or account information on your phone, enhancing your security.

- Extra Protection: Security codes provide additional protection when logging in from unrecognized devices.

- Fraud Protection Guarantee: Their online and mobile security guarantee protects you against fraudulent transactions.

Important Information to Consider

Before diving into Ally's services, here are a few key points to keep in mind:

- Free Ally App: The Ally app is free to download, though your mobile carrier’s message and data rates may apply.

- FICO® Trademark: FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

- FDIC Membership: Deposit and mortgage products are offered by Ally Bank, Member FDIC; Equal Housing Lender, NMLS ID 181005.

- Savings Features: Buckets and boosters are features of the Ally Bank Savings Account, while spending buckets are part of the Ally Bank Spending Account.

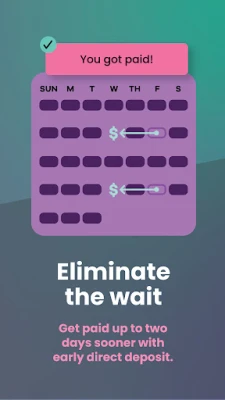

- Early Direct Deposit: Enjoy eligible direct deposits up to two days sooner with Ally Bank’s Spending Account.

- Securities Products: Offered through Ally Invest Securities LLC, member of FINRA and SIPC. Advisory services are provided by Ally Invest Advisors Inc., a registered investment adviser.

- Commission-Free Trading: Ally Invest does not charge commissions for stocks and ETFs priced at $2 and higher, with specific fees for lower-priced stocks.

Conclusion

Ally Financial offers a comprehensive range of services designed to meet your financial needs. From auto loans to investment strategies, their user-friendly platforms and commitment to security make them a strong choice for managing your finances. Explore the benefits of Ally today and take control of your financial future.

Rate the App

User Reviews

Popular Apps

Editor's Choice