Latest Version

8.71.0

March 03, 2025

Acorns

Finance

Android

0

Free

com.acorns.early

Report a Problem

More About Acorns Early: Kids Money App

Unlocking Financial Literacy: The Comprehensive Guide to Acorns Early

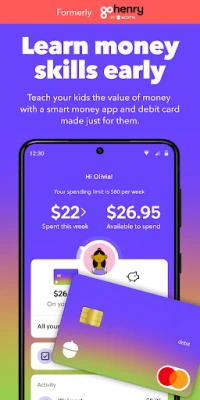

In today's fast-paced world, teaching children about money management is more crucial than ever. Acorns Early offers a unique platform designed to instill essential financial skills in kids from a young age. This article delves into the standout features of Acorns Early, highlighting how it empowers both children and parents in their financial journeys.

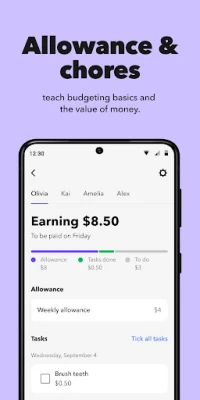

Automated Allowance: A Smart Start to Budgeting

Acorns Early introduces an automated weekly allowance feature that helps children learn the fundamentals of budgeting. By receiving a set amount of money each week, kids quickly grasp the concept that once their funds are depleted, they must wait for the next allowance. This practical experience fosters responsible spending habits early on.

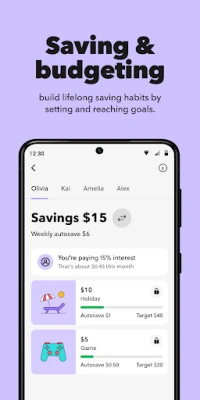

Saving & Budgeting: Cultivating Financial Habits

With Acorns Early, saving becomes a natural part of a child's routine. The platform allows for child-led savings goals, which parents can easily lock and unlock. This feature encourages kids to set their own financial targets, making saving a fun and engaging activity rather than a chore.

In-App Task Lists: Earning Through Chores

Teaching the value of hard work is essential, and Acorns Early makes it easy with in-app task lists. Parents can assign chores and reward their children for completing them, reinforcing the idea that earning money requires effort. This gamified approach to chores not only motivates kids but also instills a sense of accomplishment.

Bite-Sized Lessons: Enhancing Financial Literacy

Acorns Early features Money Missions, which are bite-sized lessons designed to boost financial literacy. On average, children who complete these missions transfer over 30% more into their savings within the first month. These engaging lessons make learning about money enjoyable and effective.

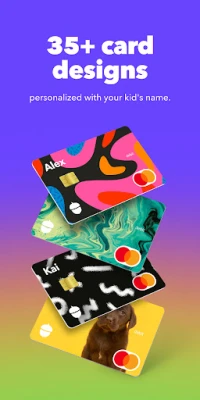

Your Own Prepaid Card: Real-World Practice

One of the standout features of Acorns Early is the kids' debit card. Children can practice their newfound financial skills in real-world scenarios, choosing from over 45 card designs. This hands-on experience helps them understand the importance of managing their money responsibly.

Travel Abroad Fee-Free: Stress-Free Vacations

Traveling with kids can be challenging, but Acorns Early simplifies it with fee-free transactions overseas. Parents can rest easy knowing their children can use their cards abroad without incurring extra charges, making family vacations more enjoyable.

Money Skills Unlocked: Tracking Cash Flow

Acorns Early empowers children to take control of their finances by allowing them to monitor their cash flow directly within the app. This feature helps kids understand where their money goes, promoting better financial decision-making.

ATM Withdrawals: Cash When Needed

For situations that require cash, Acorns Early provides the option for ATM withdrawals. This feature ensures that children can access their funds when necessary, teaching them about cash management in various scenarios.

Parent Features: Empowering Financial Education

Acorns Early is not just beneficial for kids; it also offers a range of features tailored for parents. Here’s how parents can enhance their child's financial education:

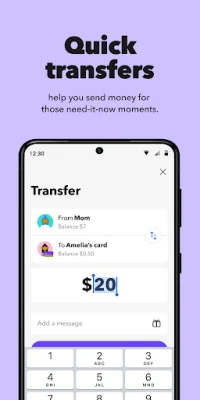

Quick and Easy Transfers

Parents can send money effortlessly with scheduled allowances and instant transfers. This flexibility allows for seamless financial management.

Incentivize Chores

By setting task lists and rewarding completed chores, parents can motivate their children to earn money while learning valuable life skills.

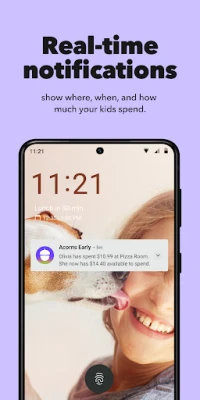

Spending Visibility

Stay informed about your child's spending habits with real-time notifications sent directly to your phone. This feature enhances transparency and encourages discussions about financial choices.

Flexible Controls

Parents have the power to dictate when, where, and how much their child can spend. These flexible controls can be adjusted anytime within the app, ensuring peace of mind.

For the Whole Family

Acorns Early allows friends and family to contribute to your child's financial education through Giftlinks and Relatives accounts. This feature fosters a supportive financial community.

Just for You: Insights and Tips

In the Parent Space, parents can access valuable insights and tips to further support their child's financial education, ensuring a well-rounded approach to learning.

Giving Made Easy

Teach your child the importance of philanthropy with optional charitable donations available in-app. This feature encourages empathy and social responsibility.

Teen Features: Preparing for Independence

As children grow into teenagers, Acorns Early adapts to their evolving needs with features designed specifically for them:

The Account That Grows With You

Teens can enjoy a smart debit card and a dedicated account with features tailored to their age group, promoting independence and responsibility.

Split the Bill

Teens can easily request or send money to friends using Acorns Early, making group outings and shared expenses hassle-free.

Request Money, Get Paid

With the ability to use QR codes, teens can receive payments in person, even from those who do not use Acorns Early.

Savings You Control

Teens can set their own savings goals within the app, empowering them to save for desired purchases and experiences.

Ready for Your Side Hustle

Acorns Early supports teens with Direct Deposits for their side hustles, making it easy to manage their earnings.

Free to Pay Away

Traveling abroad? Teens can enjoy fee-free transactions overseas, allowing them to explore without financial worries.

Map Your Spending

Teens can track their spending habits with spending maps, helping them make informed financial decisions.

Getting Started with Acorns Early

Ready to

Rate the App

User Reviews

Popular Apps

Editor's Choice