Latest Version

4.4.3

March 26, 2025

Access Bank plc

Finance

Android

0

Free

com.accessbank.accessbankapp

Report a Problem

More About Access Bank (Ghana) Plc

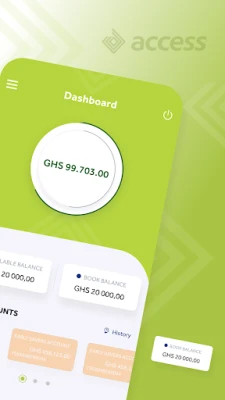

Unlock the Power of Mobile Banking with Access Bank: Your Ultimate Guide

In today's fast-paced world, managing your finances on the go has never been easier. With the Access Bank Mobile Banking app, you gain real-time access to your accounts, empowering you to handle your banking needs anytime, anywhere. This service is available to all Access Bank account holders at no cost, making it a convenient choice for anyone looking to streamline their banking experience.

Key Features of the Access Bank Mobile Banking App

The Access Bank Mobile Banking app offers a wide array of features designed to simplify your financial management. Here are some of the standout services you can enjoy:

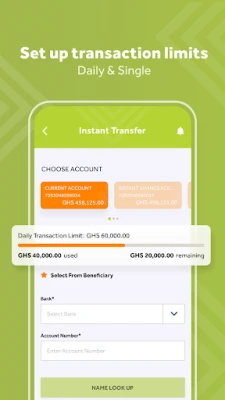

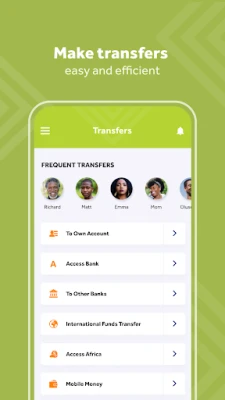

- Transfers to Access Bank Accounts: Seamlessly transfer funds between your Access Bank accounts with just a few taps.

- Interbank Transfers: Send money to accounts in other banks across Nigeria effortlessly.

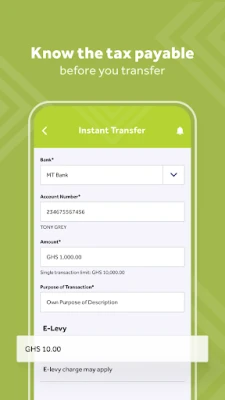

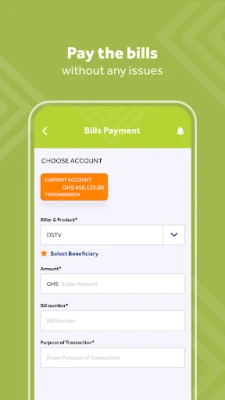

- Bill Payments: Pay your utility bills, including electricity and water, directly through the app.

- Cable TV Payments: Easily recharge your cable TV subscription without any hassle.

- Airtime Purchases: Top up your mobile phone with airtime in seconds.

- Power Payments: Manage your power bills conveniently from your mobile device.

- Cheque Book Requests: Request new cheque books directly through the app.

- Cheque Confirmation: Verify the status of your cheques quickly and easily.

- Cheque Cancellation: Stop or cancel cheques with a few simple clicks.

- Branch and ATM Locator: Find the nearest Access Bank branches and ATMs to you.

- And Much More: Explore additional features that enhance your banking experience.

Getting Started: Access Your Account in 3 Simple Steps

Accessing your account through the Access Bank Mobile Banking app is straightforward. Follow these three simple steps to get started:

- Download the App: Visit your device's app store and download the Access Bank Mobile Banking app.

- Register Your Account: Follow the on-screen instructions to register your account using your Access Bank details.

- Log In: Use your credentials to log in and start enjoying the app's features.

Security First: Using Your Authentication Token

To ensure the safety of your transactions, the Access Bank Mobile Banking app requires an authentication token. This token is essential for performing banking transactions within the app. If you do not have an authentication token, simply visit any Access Bank branch to obtain your transaction PIN. This added layer of security helps protect your financial information and provides peace of mind while banking online.

Why Choose Access Bank Mobile Banking?

The Access Bank Mobile Banking app stands out for its user-friendly interface and comprehensive features. Here are a few reasons why you should consider using this app:

- Convenience: Manage your finances from anywhere, at any time, without the need to visit a physical branch.

- Cost-Effective: Enjoy all the features of the app without incurring any subscription fees.

- Time-Saving: Complete transactions quickly, allowing you to focus on what matters most.

- Enhanced Security: Benefit from robust security measures that protect your personal and financial information.

Conclusion: Embrace the Future of Banking

The Access Bank Mobile Banking app is more than just a banking tool; it’s a gateway to a more efficient and convenient financial life. With its extensive features and commitment to security, this app is designed to meet the needs of modern banking customers. Don’t miss out on the opportunity to simplify your banking experience. Download the Access Bank Mobile Banking app today and take control of your finances like never before!

Rate the App

User Reviews

Popular Apps

Editor's Choice